Issued: April 26, 2013

Impact: All US GAAP

Issue

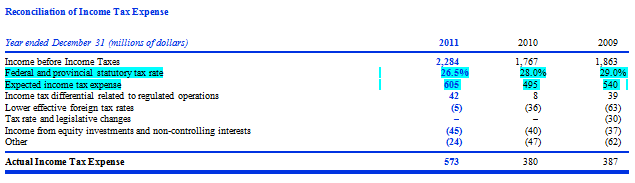

In a number of cases, companies combine the federal and provincial state rates as a starting point for the tax reconciliation.

Figure 16. Tax Reconciliation

However, the US GAAP taxonomy reconciliation starts with the federal tax rate. In these cases, should the filer create an extension element for the combined rates and also create extensions for the interim adjustment elements or use the existing US GAAP elements?

Recommendation

In those cases where the federal and provincial rates are combined, then an extension element should be created for the amount that combines the federal and state rate. In addition, the reconciliation items should use extension items.