Issued: April 29, 2011

Impact: All US GAAP

Issue

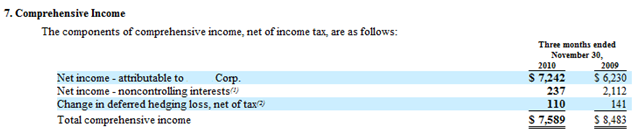

Sometimes financial information is reported by filers in a way such that XBRL calculation relationships become invalid. Typically, this occurs when filers reconcile between two numbers in a financial statement. See the table and examples below:

Potential element selections for the above table:

- NetIncomeLoss (Balance Type: Credit)

- NetIncomeLossAttributableToNoncontrollingInterest (Balance Type: Debit)

- OtherComprehensiveIncomeDerivativesQualifyingAsHedgesNetOfTaxPeriodIncreaseDecrease(No Balance Type)

- ComprehensiveIncomeNetOfTaxIncludingPortionAttributableToNoncontrollingInterest (Balance Type: Credit)

Since 1 and 2 above are both added in the calculation (1 is a credit and 2 is a debit), it becomes impossible to create an appropriate calculation relationship.

Since the parent of calculation (4) is a credit, there are illegal weight values as defined in the XBRL 2.1 specification at 5.1.1.2. This means modification of the calculation weight to address this issue would not be appropriate because it would create invalid XBRL 2.1.

Recommendation

To address the calculation inconsistency, the calculation should be defined as follows:

NetIncomeLoss (Child) 7,242 NoncontrollingInterest (Child) (+1) 237 PeriodIncreaseDecrease (Child) (+1) 110 ComprehensiveIncomeNetOfTax (Parent) 7,589

By rearranging the calculation, the filing will contain a calculation parent that does not have a total label role in the presentation hierarchy. This method of defining the calculation will result in a difference between the calculation hierarchy and the presentation hierarchy. In this case, it is better to define a reversed calculation than not to define a calculation at all.