Issued: May 27, 2011

Impact: All US GAAP

Issue

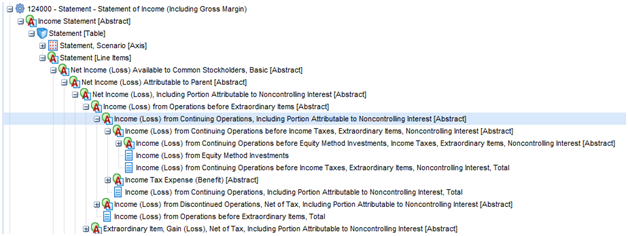

What concept should be used to represent Income (Loss) from Continuing Operations before Taxes when modeling an income statement if income from equity method investments does not exist? Should the filer use “Income (Loss) from Continuing Operations before Income Taxes, Extraordinary Items, Non-controlling Interest, Total” or should they use “Income (Loss) from Continuing Operations before Equity Method Investments, Income Taxes, Extraordinary Items, Non-controlling Interest, Total?”

If an SEC filer has “Income (Loss) from Equity Method Investments,” it is clear which concept represents “Income (Loss) from Continuing Operations before Taxes” on the income statement. However, if a filer does not have Equity Method Investments, it is less clear.

In the filings to date, the concept “Income (Loss) from Continuing Operations before Equity Method Investments, Income Taxes, Extraordinary Items, Non-controlling Interest” is far more commonly used than “Income (Loss) from Continuing Operations before Income Taxes, Extraordinary Items, Non-controlling Interest”. Current practice is to use the more general item, which includes EquityMethodInvestments, even though this element is present only 20% of the time when “Income (Loss) from Continuing Operations before Equity Method Investments, Income Taxes, Extraordinary Items, Non-controlling Interest” is actually used.

Recommendation

The concept with the standard label “Income (Loss) from Continuing Operations before Income Taxes, Extraordinary Items, Non-controlling Interest, Total” and element name IncomeLossFromContinuingOperationsBeforeIncomeTaxesExtraordinaryItemsNoncontrollingInterest should be used when EquityMethodInvestments does not exist. This reflects the logic of using the element that reflects the more specific element of the two.