Issued: February 1, 2013

Impact: All US GAAP

Issue

When a dividend is declared, the declared date, the record date and the payment date are almost always also disclosed. All of these have standard tags. But what should the context date be, especially if these dates are in the future and/or multiple dividends are disclosed in the financial statement notes?

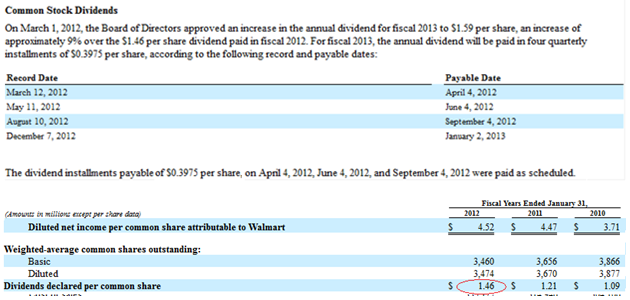

Here is an example disclosure of a retailer with a January 31st year-end. The fiscal year of the disclosure is 2013, referred to as fiscal year of FY2013.

Recommendation

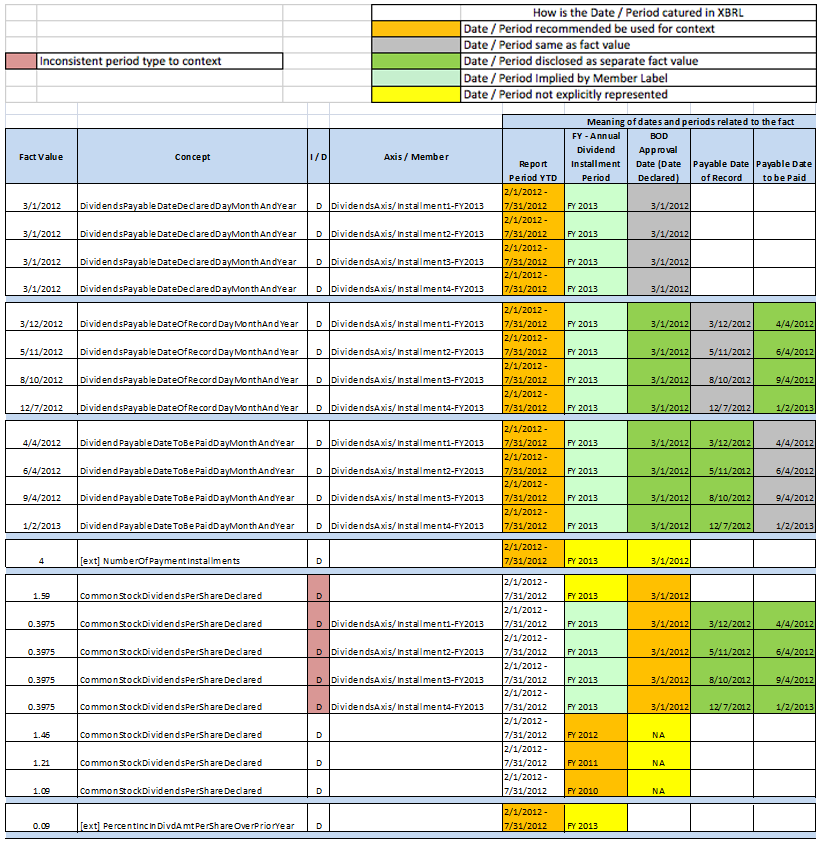

In order to capture this information, each separate dividend should be defined using a separate member on the Dividends Axis. This allows the details of the separate dividends to be defined. This logic is consistent with the approach taken for acquisitions where a member is added for the acquisition event. In general, any event or transaction should be established with a separate member to distinguish it from transactions or events of a similar nature so that facts associated with the transaction are grouped together. The following table summarizes the different contexts that should be associated with the above announcement.

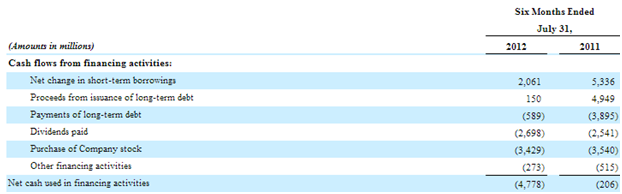

Any monetary amounts that could appear in the financial statements should have the context that reflects the date at which they were actually paid or accrued. For example, the Payment of Dividends should reflect the date the payment was made (i.e. the $2,698 and $2,541 should reflect the amount in the cash flow statement for the six months ended July 2012 and 2011, respectively). See figure below.

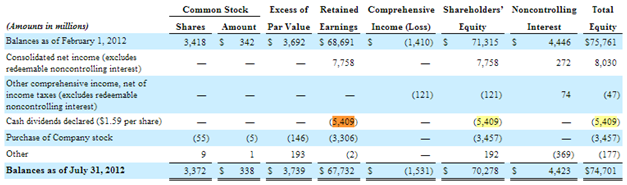

The actual aggregate amount for the dividends declared of $5,409 in orange would have a context of 2012-02-01 to 2012-07-31 to reflect the amount of dividends declared in the Statement of Shareholders’ Equity below:

In addition, the $1.59 using the CommonStockDividendsPerShareDeclared element does not have a context date range that matches the $5,409 even though this amount is calculated by multiplying $1.59 times the number of shares.

The cash amount paid per share of $0.3975 should have a context date that matches the actual payment date. If the number of shares held is multiplied by the $0.3795 for the first 2 quarters, the result is the payment amount. The context date of the declared amount per share should be the declared date.

Any value that represents a date should use the current context of the financial report. In this case, it is the 6 months from February 2012 to July 2012. Note that there is no specific requirement to tag such dates.

The facts should be grouped together by using separate unique dividend members and not an arbitrary context date. The dividend members should be on the Dividend [Axis] and should be unique from period to period. In this case, we have used the installment number and year to distinguish the dividends over a time period. This is especially important in a filing where 3 years of dividends are reported in a single filing. The following chart shows the Dates and the Date Contexts associated with each of the values in the disclosure.

Figure 20. Multiple Dividends Declared and Paid

[11] Refer to the FASB illustrative examples on Subsequent Events to determine if the Subsequent Event Type [Axis] should be used.