Issued: July 27, 2012

Impact: All US GAAP

Issue

A number of companies have questioned the balance attribute on the net income (loss) attributable to non-controlling interests.

NetIncomeLossAttributableToNoncontrollingInterest. The US GAAP taxonomy defines Non-Controlling Interest income as a debit balance. This reflects the balance that was used in the past for minority interests. The balance type reflects that this item is a reversal of revenue attributable to non-controlling interests from the net income for the consolidated group. In a number of cases, companies believe that this represents net income and should be represented as a credit balance type. The impact is that net income gets entered as a negative balance and net loss as a positive to compensate for the difference in sign.

Recommendation

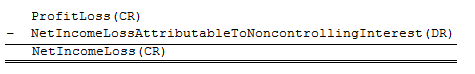

The taxonomy is designed from the perspective of the parent company in this regard rather than the perspective of the consolidated entity. From the perspective of the consolidated entity, it would be a credit; from the perspective of the company’s shareholders, it is a debit. In the US GAAP taxonomy, the item is modeled from the perspective of the shareholder. The calculation of the item also reflects this in the taxonomy where:

This item’s natural balance is a debit and should be tagged as a positive amount for income attributable to the non-controlling interest and as a negative for a loss to the non-controlling interest.