Issued: November 30, 2012

Impact: All US GAAP

Issue

There are a number of notional concepts for derivative contracts defined in the US GAAP taxonomy. The notional amount is the face value of a derivative contract. Companies typically report the notional amount of a contract in their financial statements if they have either purchased or sold a derivative contract. The notional amount will be the same if the contract is sold by the filer or purchased by the filer. In order to capture the fact that the contract has been sold, the notional amounts have been entered as a negative value by filers. Notional disclosures can be relatively simple or very complex particularly for banks with large derivative positions. These notional disclosures are typically disclosed two different ways, as illustrated below:

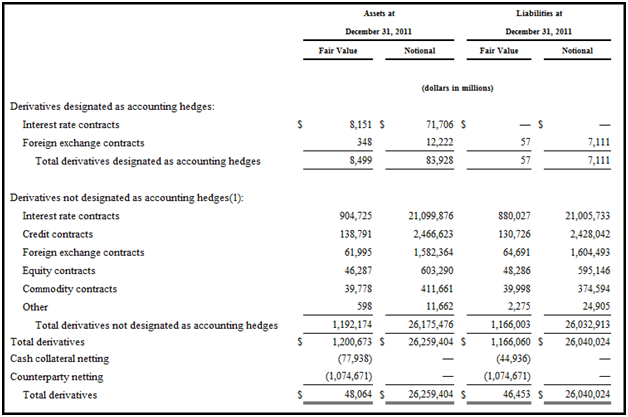

Figure 11. Notional Assets and Liabilities

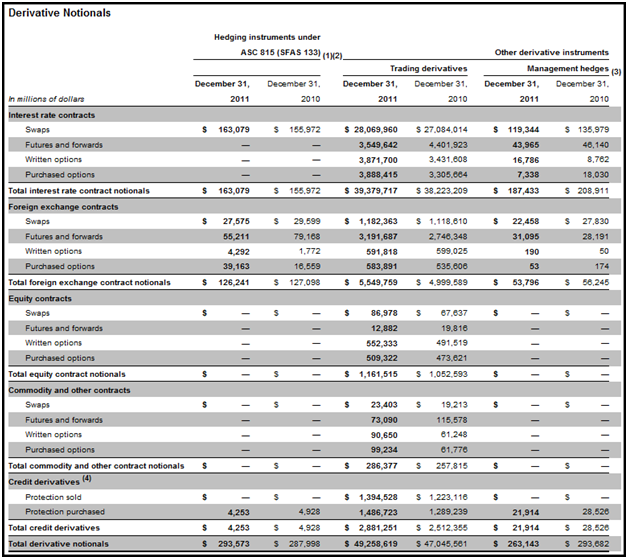

Figure 12. Notional for All Derivatives

Certain filers also disclose the notional amounts associated with derivative assets and derivative liabilities, (See Figure 11 - Notional Assets and Liabilities) while others just disclose the notional amount associated with derivatives unassociated to assets or liabilities (See Figure 12 - Notional for All Derivatives).

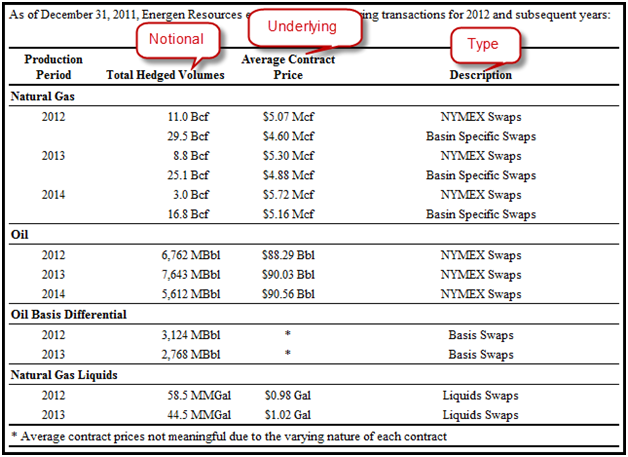

Figure 13. Derivative Notional Amount

In Figure 13 above, the filer is disclosing the total hedged volume and the average contract price. The volumes hedged are disclosed using different measures applicable for the specific contract, i.e., Mcf (volumeItemType), Bbl (volumeItemType) and Gal (volumeItemType). In addition, the filer has disclosed the average contract price for the derivative.

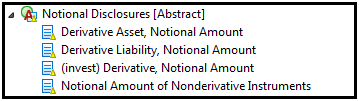

To facilitate the different reporting adopted for notional amounts, the FASB in the 2013 UGT, deprecated the specific monetary notional amount elements, retaining these three:

- DerivativeAssetNotionalAmount

- DerivativeLiabilityNotionalAmount

- DerivativeNotionalAmount (part of invest taxonomy)

And adding the following one:

- NotionalAmountOfNonderivativeInstruments

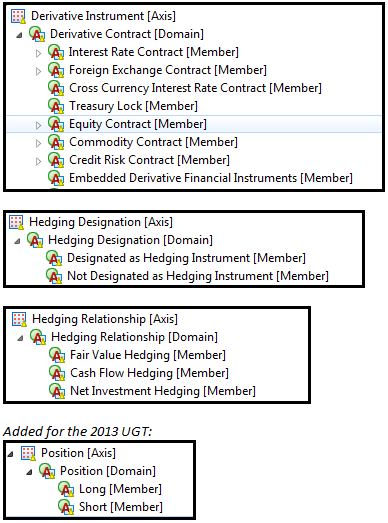

Any further attribute qualifications that filers need to apply should be done so by using the following dimensions:

In addition, in the 2013 UGT, the FASB has added the following elements to address the case detailed in Figure 13.

Note that different elements exist in the taxonomy to measure the nonmonetary notional amounts. The taxonomy currently defines three of these so that a different measure defined in the contract can be expressed using the units registry. In some cases a contract may use a different measure for the notional. In these cases the company should create an extension element for these concepts.

Recommendation

Notional disclosure

To record the value of the notional amount of 71,706 in the first example the following would be tagged:

DerivativeAssetNotionalAmount dimensionally qualified with the following:

| Axis | Member |

| Derivative Instrument [Axis] | Interest Rate Contract [Member] |

| Hedging Designation [Axis] | Designated as Hedging Instrument [Member] |

Note that the Position [Axis] is not used as the company has not broken the contracts into long and short positions.

To record the value of the notional amount of 3,871,700 in the second example, the following would be tagged:

DerivativeNotionalAmount dimensionally qualified with the following:

| Axis | Member |

| Derivative Instrument [Axis] | Interest Rate Contract [Member] |

| Hedging Designation [Axis] | Not Designated as Hedging Instrument [Member] |

| Position [Axis] | Short [Member] |

In Figure 13, the value of 11.0 Bcf would be reported with the element DerivativeNonmonetaryNotionalAmountVolume and the following dimensional qualifications:

| Axis | Member |

| Derivative Instrument [Axis] | NYMEX Swap-Natural GAS 2012 [Member] |

| Hedging Designation [Axis] | Designated as Hedging Instrument [Member] |

The value of 5.07Mcf for the average contract price in the first line would be reported with the element:

DerivativeSwapTypeAverageFixedPrice and the following dimensional qualifications:

| Axis | Member |

| Derivative Instrument [Axis] | NYMEX Swap-Natural GAS 2012 [Member] |

| Hedging Designation [Axis] | Designated as Hedging Instrument [Member] |

Short Positions

The tag DerivativeNonmonetaryNotionalAmount, for example, has been reported in a significant amount of filings. Of these filings, a large portion are tagged with negative amounts to express that the contract has been sold. Because this item is not a monetary amount, it does not represent an accounting concept; it does not have a balance type and is not a credit or debit. The description of the element does not indicate that a negative value reflects a sale of the contract. In fact, if a negative implies it is sold, then positive assumes the filer is long. If the company is providing information about the notional amount as a fact, it would imply the company is currently long the amount.

To complete the information associated with the notional amount, the filer needs to communicate if the notional amount represents either general information about a contract, the fact that the contract has been purchased or the contract has been sold. To communicate the side of the contract the filer is on, additional information needs to be provided. To report this information, the filer should define the long and short position by creating extension members to reflect if the position is short or long. These extensions should match the Position dimension in the 2013 taxonomy (see above).