Issued: February 25, 2011

Impact: All US GAAP

Issue

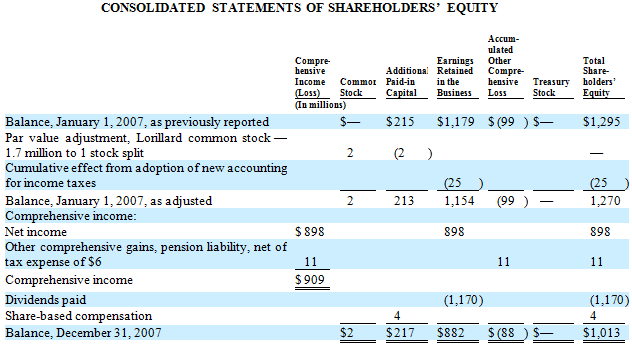

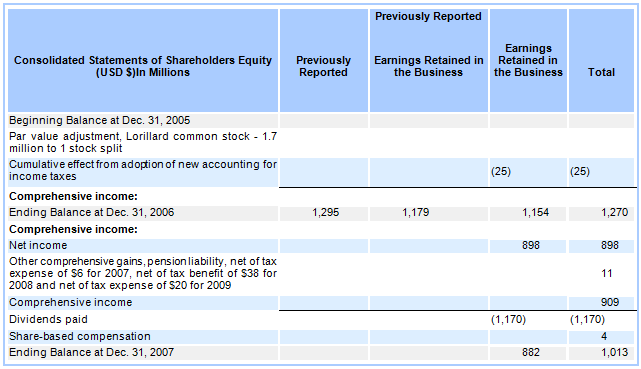

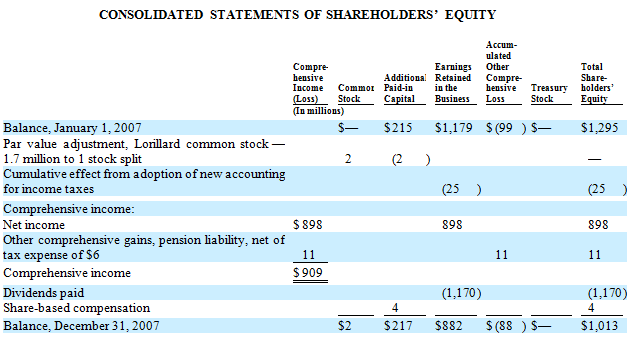

Depending on the filer, restatements of opening shareholders’ equity is being handled in a number of different ways. In the example below, a company has adjusted their opening balance.

We have seen this handled in a number of different ways. Concentrating on the Retained earnings, the following approaches have been observed.

Approach 1

The balance previously reported of $1,179 is dimensionally qualified with the following line item and dimensions:

c = StockholdersEquity AND

StatementScenarioAxis= ScenarioPreviouslyReportedMember AND

StatementEquityComponentsAxis=RetainedEarningsMember.

The newly restated balance reported of $1,154 is dimensionally qualified with the following line item and dimensions:

LineItem = StockholdersEquity AND

StatementEquityComponentsAxis=RetainedEarningsMember

The balance previously reported of ($25) is dimensionally qualified with the following line item and dimensions:

LineItem = CumulativeEffectOfInitialAdoptionOfFIN48 AND

StatementEquityComponentsAxis=RetainedEarningsMember

Note that the cumulative impact is defined as a duration line item, the period of which is recorded as a year. Effectively, this cumulative adjustment should really be an instant in the same manner that accumulated depreciation is an instant. It represents the portion of the opening balance of retained earnings that is no longer income.

This statement looks like this in the SEC rendering engine:

Figure 23. SEC Rendering

Approach 2

This has been the SEC guidance in the past which was to not use the ScenarioAxis for restatements or adjustments on equity statements and not to create elements to represent balances after adjustment. Balances after adjustment are represented using the ‘normal’ elements. So in the case above, the values would be as follows:

The balance previously reported of $1,179 is dimensionally qualified with the following line item and dimensions:

LineItem = StockholdersEquityPreviouslyReported (This is an extension) AND

StatementEquityComponentsAxis=RetainedEarningsMember.

The newly restated balance reported of $1,154 is dimensionally qualified with the following line item and dimensions:

LineItem = StockholdersEquity AND

StatementEquityComponentsAxis=RetainedEarningsMember

The balance previously reported of ($25) is dimensionally qualified with the following line item and dimensions:

LineItem = CumulativeEffectOfInitialAdoptionOfFIN48 AND

StatementEquityComponentsAxis=RetainedEarningsMember

Approach 3

We also observed the following approach being taken in some cases. This is where the filer reports the pre adjusted item using the following:

LineItem = StockholdersEquity AND

StatementEquityComponentsAxis=RetainedEarningsMember

The newly restated balance reported of $1,154 is dimensionally qualified with the following line item and dimensions:

LineItem = StockholdersEquityNewlyReported (This is an extension) AND

StatementEquityComponentsAxis=RetainedEarningsMember.

The balance previously reported of ($25) is dimensionally qualified with the following line item and dimensions:

LineItem = CumulativeEffectOfInitialAdoptionOfFIN48 AND

StatementEquityComponentsAxis=RetainedEarningsMember

Approach 4

The fourth approach observed was a straight roll-forward from the start of the year to the end. In these cases, the adjustment to opening balance appears as a durational concept. The previous statement would be modeled as if the adjusted interim balance was not included in the table.

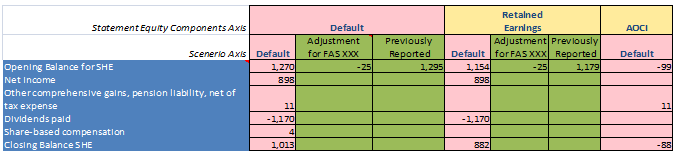

Approach 5

This approach is similar to approach 1 in that it uses the scenario axis but also captures the adjustment as a member rather than a line item. This approach does not require an extension and reflects the fact that the cumulative adjustment should be an instant.

Figure 24. Adjustment Modeled as a Dimension

Recommendation

Having five different approaches to recording adjustments in filings makes it more costly to normalize this information into a consistent dataset. Each of these approaches has their own limitations.

We are recommending approach 5 that uses the scenario axis but also recognizes the adjustment as a member rather than a line item. This approach is preferred because it does not require an extension and is more consistent with other modeling in the taxonomy.

This approach has the following advantages:

- New extension items are limited.

- It reflects the fact that the cumulative adjustment should be an instant.

The obvious disadvantage is the ability of the rendering engine to make it look like the original filing.