Issued: January 6, 2012

Impact: All US GAAP

Issue

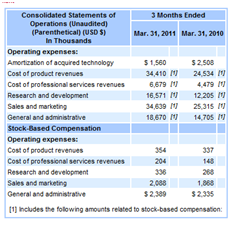

The reporting of stock-based compensation split over various expense categories in the income statement is inconsistent across a number of filings. The taxonomy provides a table[1] that allows a filer to dimensionally qualify the stock-based compensation between the following members:

- Cost of Sales

- Research and Development

- Selling and Marketing

- Restructuring

- General and Administrative

However, in practice filers have used the following approaches:

- Approach 1 - Used the equivalent expense items to the members as the line item GeneralAndAdministrativeExpense and dimensionally qualified it by using a taxonomy element such as StockBasedCompensationPlanMember shown in Figure 17 or an extension member like StockBasedCompensationMember.

- Approach 2 - Used either AllocatedShareBasedCompensationExpense or ShareBasedCompensation items and qualified them by members that represent the income statement categories.

- Approach 3 - Created extension items to represent the different categorizations.

The intention of the FASB is that Approach 2 should be used.

Recommendation

Use Approach 2 and dimensionally qualify the stock-based compensation line item between the following members:

- Cost of Sales (CostOfSalesMember)

- Research and Development (ResearchAndDevelopmentExpenseMember)

- Selling and Marketing (SellingAndMarketingExpenseMember)

- Restructuring (RestructuringChargesMember)

- General and Administrative (GeneralAndAdministrativeExpenseMember)

[1] ScheduleOfEmployeeServiceShareBasedCompensationAllocationOfRecognizedPeriodCostsTable