Issued: July 26, 2013

Initially issued March 25, 2011

Impact: All US GAAP

Issue

In an analysis of filings last quarter, it was observed there is a difference in how a number of registrants define and tag “no par.” There are three common approaches that were identified:

- Approach 1: Tagging the fact with the element CommonStockNoParValue and a value of 0.

- Approach 2: Tagging the fact with the element CommonStockNoParValue with no value and setting the nil=True attribute.

- Approach 3: Tagging the fact with the element CommonStockParOrStatedValuePerShare and a value of 0.

The definition of these concepts is as follows:

CommonStockNoParValue:

2012 - Issuance value per share of no-par value common stock; generally not indicative of the fair market value per share.

2013 - Face amount per share of no-par value common stock.

CommonStockParOrStatedValuePerShare: Face amount or stated value of common stock per share; generally not indicative of the fair market value per share.

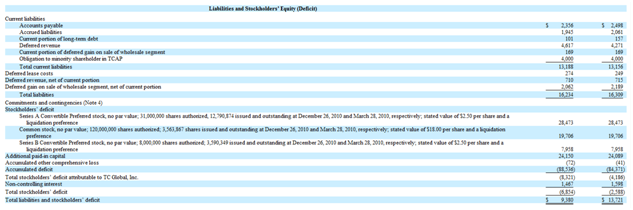

In the case below, the company has no par value with stated value:

Figure 2. Tagging Common Stock No Par Value

In Figure 2, the company has Common stock, no par value, 120,000,000 shares authorized, 3,563,867 shares issued and outstanding at December 26, 2010 and March 28, 2010, respectively; stated value of $18.00 per share and a liquidation preference.

Recommendation

Where there is Common Stock with no par value, then the tag CommonStockNoParValue should be included in the instance with a value of nil or zero. In the case where no par value shares are reported but a stated value is reported, then an extension element should be used to record the issuance amount. The element CommonStockNoParValue, if populated, indicates that the common stock is no par value.