Issued: October 4, 2013

Impact: All US GAAP

Issue

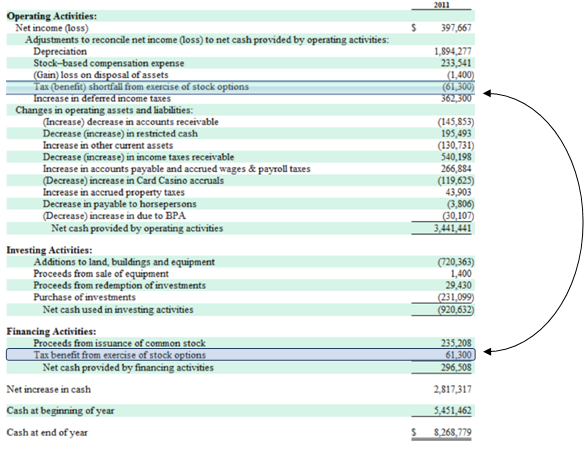

A large number of filings are using inappropriate signs for the elements: ExcessTaxBenefitFromShareBasedCompensationOperatingActivities and ExcessTaxBenefitFromShareBasedCompensationFinancingActivities

Both of these elements should be entered as positive amounts. The first element represents the exclusion of recognized excess tax benefits generated from the exercise of stock options from Operating Activities pursuant to GAAP reporting requirements. The second element represents the transfer of that amount to the Financing Activities of the cash flow statement.

In the example below, the company shows the transfer of tax benefits from operating to financing in 2011. Both of these amounts must be entered as positive amounts, and the amounts should be the same. In this case, the company shows parenthesis for the benefit, which represents the amount as a negative value in the financial statements. However in the XBRL instance, the value must be positive.

Figure 14. Tax Benefit from Exercise Stock Option

Recommendation

The values in the instance document for the elements ExcessTaxBenefitFromShareBasedCompensationOperatingActivities and ExcessTaxBenefitFromShareBasedCompensationFinancingActivities should always be positive and should represent the same amount if both numbers are shown in the cash flow statement. In addition, the same element should not be used to represent the same value in the operating and financing sections of the cash flow statement.