Browse our collection of infographics by tag/topic

Sustainability

Standards Benefit Companies, Data Collectors, Data Users

To successfully collect data under SB 253 and SB 261, California must require data be reported in digital, machine-readable (XBRL) format. There are several good reasons for this approach.

Surety

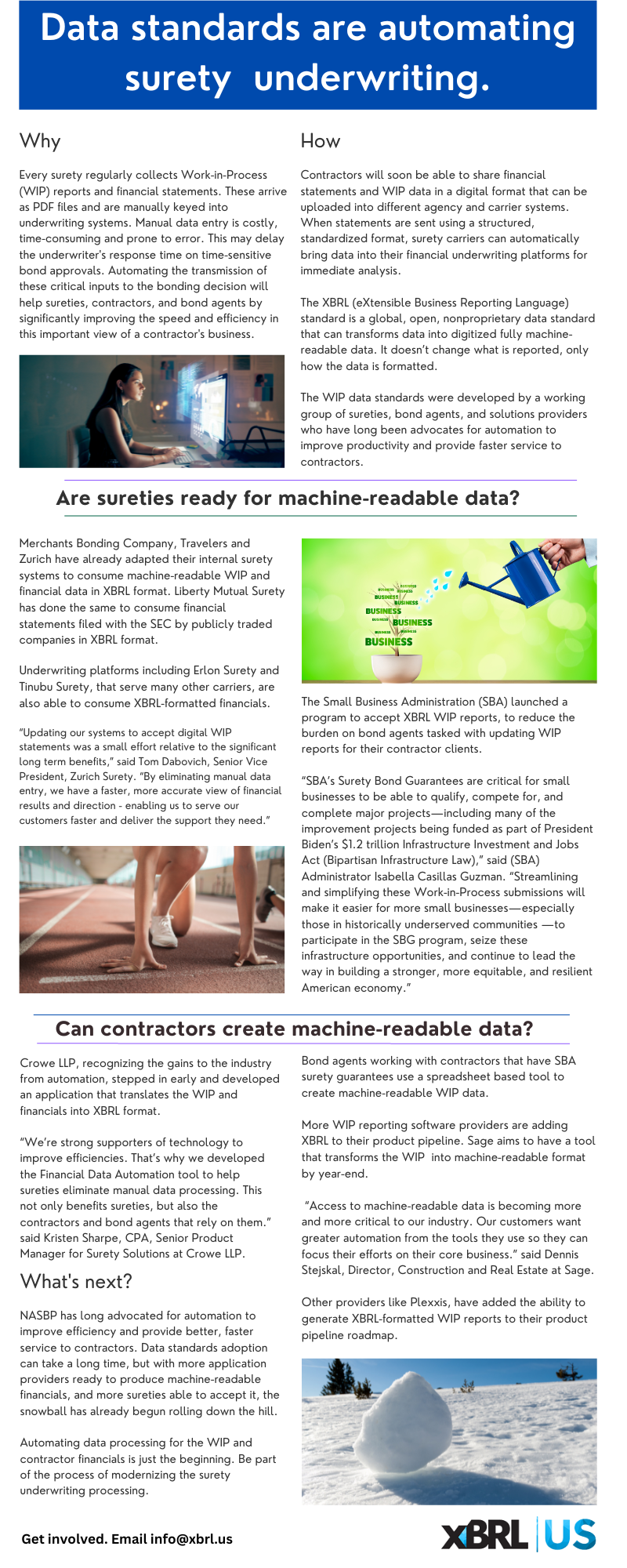

Automating the transmission of Work-in-Process reports and financial statements to the bonding decision will help sureties, contractors, and bond agents by significantly improving the speed and efficiency in this important view of a contractor’s business.

FDTA

The Financial Data Transparency Act (FDTA) calls for the use of data standards by member agencies of the U.S. Financial Stability Oversight Council, including U.S. Treasury, the Securities and Exchange Commission (SEC), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the Bureau of Consumer Financial Protection (CFPB), the Federal Reserve System, the National Credit Union Administration (NCUA), and the Federal Housing Finance Agency (FHFA).

Sponsored by Donnelley Financial Solutions (DFIN).

Standard Business Reporting (SBR)

Effective data standards programs focus on results.

Are you short-cutting efforts that sabotage the quality of the image you’re trying to share with your audience?

Comment

You must be logged in to post a comment.