By Michelle Savage, Vice President, Communications, XBRL US

Let global entities submit the same digital report sent to other regulators. Give entities that only report in California an open-source (free) tool.

Regulations being developed by the California Air Resources Board (CARB) will require certain entities that do business in California to prepare Greenhouse Gas (GHG) Emissions reports and Climate-related Financial Risk reports. While many with global regulatory obligations may already be reporting, or are soon to begin reporting this data, either to non-U.S. regulators through mandatory programs, or voluntarily to various stakeholders, reporting entities with businesses solely in U.S. markets may be starting from scratch.

Bsuinesses subject to global mandates in IFRS reporting countries for example, should be able to submit the same digital, machine-readable report to CARB that they are already submitting to satisfy non-US regulators. These companies use the IFRS’ International Sustainability Standards Board (ISSB) digital dictionary of terms (ISSB XBRL Taxonomy) to report climate-related data in structured, machine-readable (XBRL) format. ISSB reporting covers much of the data that CARB will need to collect. The ISSB is also closely aligned with the Greenhouse Gas (GHG) Protocol and the Task Force on Climate Related Financial Disclosures (TCFD) - the same global standards that are named in California legislation SB 253 and SB 261. Over 30 countries including many in Asia and Latin America are already using IFRS Sustainability standards.

In addition, entities facing the European Union’s (EU) Corporate Sustainability Reporting Directive are also disclosing data similar to those in SBs 253 and 261, and they too, must submit their data in machine-readable XBRL format.

Reporting for businesses only subject to California requirements should be a low- to zero-cost option.

Many companies that may be required to report under California climate disclosure regulations are not subject to climate mandates outside of California. They may not report voluntarily either so they may be reporting this data for the first time.

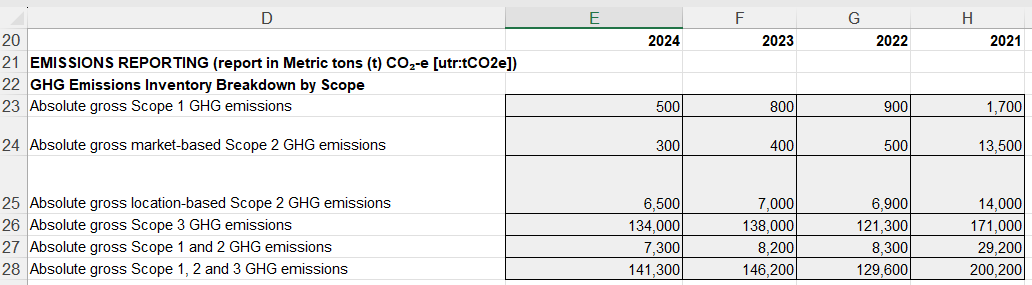

To help CARB minimize the reporting burden when complying with SB 253, we have developed a free Excel based template as shown below that any business can use to create a simple GHG emissions report with data in machine-readable format. When a company visits the site where the application is posted, they download a pre-formatted template as shown below, input their emissions data, and upload it to the tool.

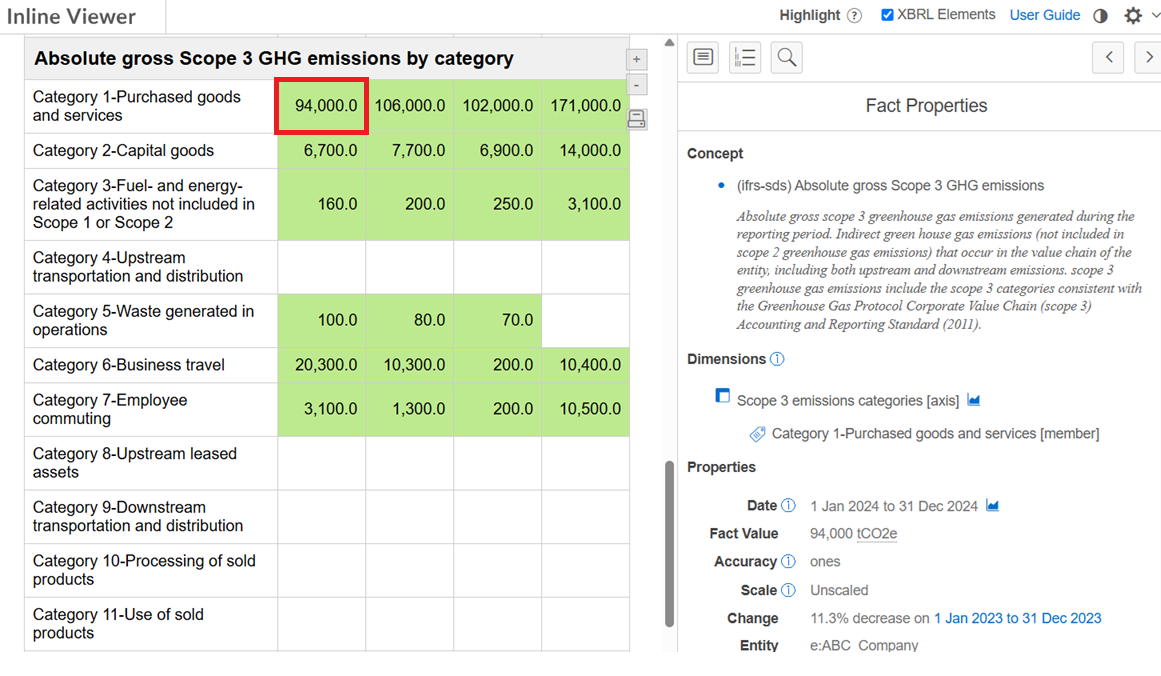

The application then converts it to a fully digital report that can be downloaded and sent on to data end users. A viewing tool is provided that lets the company check their report online and confirm that the facts are appropriately “digitized” or “tagged” with the correct concept. The visual below (click the visual for a larger view) shows the viewing tool with the fact 94,000 highlighted. The right-side popup box appears when the value is clicked on showing that it represents Absolute gross Scope 3 GHG emissions for Category 1-Purchased goods and services, in 2024 for ABC Company.

When an entity’s data is prepared this way, their emissions data is in the same structure and follows the same standards as those required to report to global regulators. Corporate GHG emissions data for all entities can be collected, extracted, and analyzed together, because the data is fully compatible and interoperable.

CARB can make this tool available to any business for little or no cost to the reporting entity. It’s fully open-source and can be leveraged as is, or revised as CARB sees fit. We know the commercial marketplace will offer up numerous low-cost, easy to use tools that will give entities lots of options for reporting. Our free, “no-frills” application was developed to illustrate the possibilities.

While this tool could be used to satisfy requirements for SB 253, a second open-source tool is being developed to help businesses report information to comply with SB 261. Narratives such as those required for climate-related financial risk reports can also be formatted in XBRL which allows for much easier extraction and analysis of text-based facts.

The tool is available now and we encourage regulators, data consumers, software providers and businesses to test it out. Try it here.