When a bank or financier is considering an investment, they review a lot of information about the project to be financed, the individuals and organizations involved, and about the state of the market at the time of financing. Each piece of the puzzle contributes some insight into the picture of the viability of the project and the prospects for getting a return on investment.

Financial statements provide an important historical snapshot of the financial health of an organization or project and are a key part of the due diligence process. Today, U.S. public companies are required to format their financial statements using the XBRL financial data standard, before submitting them to the Securities and Exchange Commission. XBRL makes the content of the financial statements computer-readable, and substantially more efficient to process and analyze for regulators and investors.

Evaluating cash flows requires more than just statements

But financial statements are just one piece of the puzzle in evaluating cash flows from an investment. When making an acquisition, or deciding to finance a business activity through debt or equity financing, lots of information, financial and otherwise, must be collected, and evaluated. A vast number of contracts, reports, analyses, and documents must be analyzed, often reviewed by multiple parties, and transferred from one organization to another before funds can exchange hands. Data collection is necessary not only when initiating a project, but for ongoing monitoring of a project.

Shouldn’t all the pieces of the cash flow puzzle be available in the most efficient, cost-effective manner possible?

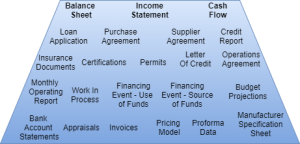

The diagram below depicts the kind of information that must be collected when acquiring or financing a business through equity or debt. The balance sheet, income statement, and cash flow statements are just the starting point.

Getting a small business loan, for example, requires preparing a loan application which may contain a business plan, financial results and projections, including cash flow, balance sheet, and P&L statements. The application typically also contains resumes, tax returns, and personal finance information about the owners.

Gathering data about customers is important for banks because they only make loans to organizations they know and trust. Over time, a bank collects a treasure trove of valuable data about the companies with which it does business. That customer becomes a trusted partner which is why it’s always considered easier (and less expensive) to retain an existing customer than to acquire a new customer.

Detailed information about a company isn’t easily available to other banks so the customer essentially becomes “locked in” to the bank that has access to its data. If that corporate data was easily accessible (could be automatically consumed and analyzed), the company could share its data with multiple banks which would then be competing for its business.

The end result of more accessible data? Banks can reduce the cost of loan processing if the data obtained is unambiguous and automated. The financing process would become more efficient and timely because of the availability of standardized definitions and labels for reported values, and by a mechanism to render the data computer-readable. The cost of processing would come down for banks, and the cost of financing would come down for borrowers.

Project finance is becoming more efficient with data standardization

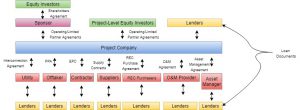

The diagram below illustrates a typical project finance structure. Project finance is widely used for large infrastructure projects and involves establishing a separate “Project Company”. Cash flows generated by the Project Company are used to pay back project debt and equity used to finance the project. In this fashion, assets of the parent company or sponsor of the project are shielded from any recourse by lenders.

Numerous players and lots of contracts and agreements are needed to develop a project finance program. In addition to the various agreements containing financial, numeric, and text data, a project finance program also requires extensive ongoing monitoring. The example in the diagram above depicts a solar renewable energy implementation and as such, contains a PPA (Power Purchase Agreement) that typically averages 20-25 years. Monthly Operating Reports, various certifications for equipment and for the solar plant itself, permits covering the site and the system, and other types of data, must be collected at the start of the project and then on a periodic basis through the life of the project.

The substantial amount of paperwork involved in project finance, both on initiation and in ongoing monitoring, makes it a lot more expensive than it needs to be. These “soft costs” can be reduced by standardizing the method used to collect and process all the data reported.

The U.S. Department of Energy and the solar industry have seen the light, and are working to develop standards for solar project finance. The outcome of this project will be a large, 3,500 element XBRL taxonomy that can be used for project finance, portfolio finance, construction finance, and insurance. And while it is closely geared around solar infrastructure projects, the taxonomy developed can also be adapted for use with other large, non-solar project finance programs, such as transportation, wind generation, natural gas, or oil.

Complete the cash flow puzzle

All the reports, contracts, and statements, necessary to evaluate cash flows related to a project or company, can be standardized using XBRL.

Data standards have already expanded beyond financial statements into other data collected for evaluation, because standards are effective at reducing unnecessary processing costs. This expansion is driven, in large part, by industry into non-compliance areas like solar reporting.

Envisioning a world where all pieces of the cash flow puzzle used for financing are computer-readable and automated will ensure the lowest cost processing for the corporate and investing public.