Issued: October 18, 2010

Impact: All US GAAP

Issue

Review of XBRL filings shows that a number of companies have reported the default value of the SharesIssued tag on the statement of shareholders’ equity as the value of shares outstanding. This element’s definition is “Number of shares of stock issued as of the balance sheet date, including shares that had been issued and were previously outstanding but which are now held in the treasury.” There is currently no tag in the taxonomy that reflects all shares outstanding, including common stock and preferred stock.

For example, a large oil company reported in its filing, a default value for SharesIssued of 4.727 billion. This figure actually reflects the value of shares outstanding on this date rather than shares issued. The company should have used the tag EntityCommonStockSharesOutstanding or CommonStockSharesOutstanding. The actual shares issued are 8.019 billion and treasury stock is 3.292 billion. The value of 8.019 billion is disclosed at the intersection of the SharesIssued element and the CommonStockMember.

In the case of a large communications company, the CommonStockSharesOutstanding line item used with the member CommonStock reflects the value of stock issued rather than shares outstanding; and the treasury stock member reflects the number of shares held in treasury.

The default value of SharesIssued should reflect the actual shares issued and not shares outstanding. Adding dimensions to a default item should not change the meaning of the default value.

Recommendation

The SharesIssued default value should equal the value of shares issued and similarly the default value of the element SharesOutstanding should equal the value of shares outstanding.

The default value of CommonStockSharesOutstanding should equal the value of common stock shares outstanding. Note that EntityCommonStockSharesOutstanding and CommonStockSharesOutstanding should have the same value.

The common stock member should represent common stock issued and not the outstanding amount. In some cases, companies report the shares outstanding in the common stock member and do not report a treasury stock member. We have noticed in a number of cases the common stock member is used for both shares outstanding and shares issued. For example, Aetna made their filing more explicit by creating another member called CommonStockOutstandingMember to capture the value of shares outstanding that did not appear as the default value.

Given that some companies combine the common stock member and treasury stock member, a different member could be used so that the issued and outstanding shares can be distinguished. However, it would be preferable that the default value of common stock shares outstanding was used as the CommonStockOutstandingMember is a duplicate of the default.

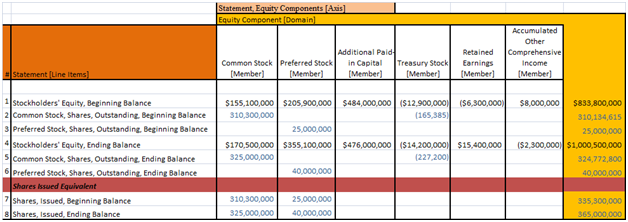

Figure 1 shows how the opening and closing balances interact with the CommonStockMember and the line items for SharesIssued and CommonStockSharesIssued. The CommonStockMember and PreferredStockMember always reflect the value of stock issued. For example, the value of 310,300,000 for Common Stock Outstanding, Beginning Balance (row 2) in the Common Stock Member should be equal to the value of Common Stock, Shares Issued (row 7, column 1).

Figure 1. Example, Shareholders’ Equity