This Q&A is intended as general guidance and should not be relied upon as authoritative. Filers are encouraged to consult with their own legal and/or with the SEC directly.

Early Adoption/Timing

Can a public company elect to tag the cover page on their 8-K using Inline XBRL before they file the first 10-Q? Or is it required to file a 10-Q using Inline XBRL first, before they can publish a form 8-K using Inline XBRL?

Yes, filers can early adopt and tag a Form 8-K.

If a calendar year-end filer files an 8-K, after June 15, but before they file their second quarter 10-Q, is that 8-K not required to have the cover page data tagged with Inline XBRL?

Yes, that is correct. This filer would not need to tag their cover page until they have filed their first 10-Q using Inline XBRL per their compliance date.

What does it mean to early adopt iXBRL compliance?[NEW 05-06-2020]

The iXBRL voluntary program was put in place to allow registrants to submit iXBRL prior to their respective iXBRL mandatory compliance date. This was established by the June 2016 exemptive order, and then extended by the 2018 iXBRL adopting release, and allowed vendors and filers to gain experience that may help facilitate the transition to iXBRL, and to take advantage of some of the process and control benefits enabled by the Inline XBRL format, like the disclosure checklist, content referencing, time series charting of company disclosures, benchmarking of peer disclosures, redlining of prior period narrative disclosures, the application of data quality rules, and identification of common data quality errors.

If an issuer were to early adopt, would they also have to comply with the FAST ACT cover page tagging requirements? [NEW 05-06-2020]

Under the voluntary inline XBRL filing program, filers can start and stop using inline XBRL at any time; and as many times as they choose, just as long as it is prior to their respective compliance mandatory date. The cover page tagging is a separate requirement and not required for voluntary iXBRL filers. However, the implementation calendar for cover page tagging aligns directly with the inline XBRL adopting release, and is staggered for filers over the 3 years, with large accelerated filers last year, accelerated filers this year, and all others next year. Filers may also early elect to tag their cover page although they are not required to do so.

If you are an accelerated filer, but also a smaller reporting company, is inline XBRL still applicable for 6/30/2020, or does the company have another year of relief because of the smaller reporting company designation?[NEW 05-06-2020]

Inline XBRL is applicable for 6/30/2020.

Is tagging of the trading symbol on the cover page for foreign private issuers required in June 2021?[NEW 05-06-2020]

Yes.

Is cover page tagging applicable to registration reports?[NEW 05-06-2020]

No.

Is cover page tagging required for an SD (special disclosure) filing?[NEW 05-06-2020]

The FAST Act applies to a broad range of forms and filings – see page 2. Form SD is not among them.

Does FAST Act cover page tagging apply to all Form 8-Ks? [NEW 05-06-2020]

Cover page tagging applies to any form 8-K submitted by a reporting entity once their iXBRL compliance date occurs. It applies to forms 10K, 10Q, 40F, 20F, but for these last 2 forms only if they’re being used for annual reports, and not as a registration statement. Cover page tagging does not apply to non-operating companies such as investment companies, business development companies or asset backed issuers.

For companies that were not previously required to have their financials tagged with inline XBRL, do they get an exemption, or have to start complete tagging just like other companies?[NEW 05-06-2020]

For operating companies previously not required to have financials tagged in iXBRL, the cover page tagging requirement aligns directly with the requirement to use the inline XBRL format. Those companies should start tagging their cover page for their 10Q and their 10K when those forms are required to be submitted in the iXBRL format.

Is tagging of the 6-K cover page required?

No, it is not required.

Specifics on Tagging

If our company does not have a Trading Symbol, do we need to tag this box?[NEW 05-06-2020]

No, it can be left blank.

What is best practice for filers that have both 12g and 12b securities registered? [NEW 05-06-2020]

This is explained in EFM 6.05.46. This is a situation where two different names are put in the same context. The EFM encourages you to put these facts in different contexts. You can find this explanation in EFM 6.05.46 in a section that starts with the statement “A company with multiple classes of securities uses additional context to distinguish the data about them …”

For filers with multiple jurisdictions what is the proper way to tag?[NEW 05-06-2020]

Each state has a legal entity state of incorporation. That is the appropriate state that they should use. The company’s state of incorporation is named in their SEC company profile and can be identified in the EDGAR system.

Clarification on Exhibits

Please explain the difference between Exhibits 101 and 104? Where are they used? [NEW 05-06-2020]

Exhibit 101 is required to be filed with any inline XBRL submission. Exhibit 101 contains the structured disclosures within the filing. Exhibit 104 is required to be filed with any cover page submission tagged with inline XBRL and it must be included as part of Exhibit 101. Exhibit 104 should be referenced in any EDGAR submission if the form includes an Exhibit index. Forms that do not include an Exhibit index, do not need to reference Exhibit 104. As an example, some 8-Ks require the inclusion of an Exhibit index, and other form 8-Ks do not require the inclusion of an Exhibit index.

What happens if an issuer has already filed an iXBRL doc that does not reference Exhibit 104 [NEW 05-06-2020]

The filer should add the Exhibit 104 reference in their next iXBRL filing.

Should filers reference Exhibit 104 in 8-Ks as well? [NEW 05-06-2020]

Yes, if the filing document contains an Exhibit index. Filings that do not have an Exhibit index, should not reference Exhibit 104.

What should be included in a form 8-K when there are other Exhibits attached? [NEW 05-06-2020]

The company should include a reference to Exhibit 104 when there are other Exhibits attached, for example “104 cover page interactive data file (embedded within the iXBRL document)”, something short and direct.

What is Exhibit 101?

The exhibit required to be filed with your Inline XBRL submission.

What is Exhibit 104?

Exhibit 104 is the document cover page tagged in Inline XBRL. It describes the required content in the Inline XBRL document. Exhibit 104 must be included as part of Exhibit 101.

Do I need to reference Exhibit 104 anywhere in my EDGAR submission?

Yes, if the filing document contains an exhibit index. Forms that do not include an exhibit index do not need to reference Exhibit 104. For example, Form 10-Q requires the inclusion of “Item 6. Exhibits”. Some Form 8-Ks require the inclusion of an exhibit index and some Form 8-Ks do not require the inclusion of an exhibit index.

How do I reference Exhibit 104 in my submission?

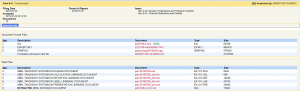

Exhibit 104 should be included in the exhibit index, if the filing document includes an exhibit index. An example of this is shown below.

See the full Inline XBRL filing of this example. The exhibit index is on page 27.

Please provide an example of a Form 8-K with cover page tagged using Inline XBRL.

Example Inline XBRL documents:

On Mutual Funds

For mutual funds submitting filings that require R-tags, the R-tags will cause invalid Inline XBRL. Can they early adopt inline XBRL without applying R-tags? [NEW 05-06-2020]

Yes, they can and should. Skip the redlining. The filing will be disseminated.

The 15 day mutual fund grace period is going away. If registrants want to early adopt, can they still take advantage of the 15 day grace period because their compliance date has not passed? [NEW 05-06-2020]

It is up to the registrant, they can do it either way.

On Amendments

If an issuer is amending a filing that was submitted prior to the company’s compliance date, and now they are within their iXBRL compliance date requirement period, should the cover page of the amendment include tags? [NEW 05-06-2020]

The cover page compliance dates align directly with the inline dates. As a result, any subsequent amendments are not required to be updated using the current tagging requirements. Use the requirements in place at the tagging of the original submission filing.

In recent rules, the SEC has proposed and mandated Inline XBRL in various disclosures and form types. Can you discuss the benefits of ixbrl to the SEC and market?[NEW 05-06-2020]

The benefits of Inline XBRL accrue to filers, consumers and analysts. These benefits include some common functional capabilities including: disclosure checklist; content referencing; time series charting of company disclosures; benchmarking of peer disclosures; redlining of prior period narrative disclosures; application of data quality rules; and identification of common data quality errors within the report.

DEI Taxonomy

Can you provide a link to the DEI 2019 Taxonomy?

Link to all SEC US GAAP Taxonomies: https://www.sec.gov/info/edgar/edgartaxonomies.shtml#USGAAP2019

Link to the DEI 2019 Taxonomy: https://xbrl.sec.gov/dei/2019/dei-2019-01-31.xsd

Can new elements in the DEI Taxonomy be viewed in the FASB “yeti” viewer?

Yes.

Can you comply by creating custom tags rather than using the new elements in the 2019 DEI Taxonomy?

No, you are required to use the new tags.

Can we use the 2019 DEI Taxonomy with the 2018 US GAAP Taxonomy?

Yes, you can use these two taxonomies together.

Other Topics

For “required visible facts” that are listed as “dei” (not as “cover”), are they also required to be visible?

Most, but not all DEI facts defined in EFM 5.2.5.14, are required to be visible (note that CIK and Amendment Flag, for example, should be hidden).

In the SEC’s Inline XBRL viewer, there is a drop down menu “More Filters” which includes an option for “Source documents”. Under what situation would a filing have more than one source document?

If there is more than one document in a single filing that contains XBRL, there will be multiple sources.

If a company has multiple debts, do we use one standard tag and then dimensionalize?

If multiple securities are included in the securities table, they should be dimensionalized.

What is recommended if the registrant name on the cover of a 10-Q or 10-K is different from the registrant name associated with the CIK? Do you use the registrant name associated with the CIK?

You can either use the registrant name associated with the CIK, or you could use a hidden fact and include a reference to the hidden fact in the document.

What is a “disclosure checklist” as relates to Inline XBRL?[NEW 05-06-2020]

The Open Source Inline Viewer has been leveraged by the SEC staff and also some market vendors to expose the taxonomy reference links associated with the reported disclosures. This enables a more automated identification of the disclosures – sort of like the more traditional ‘disclosure checklist’. This allows reviewers to identify ‘expected disclosures’ that are absent from the report.

Comment

You must be logged in to post a comment.