Every once in awhile a data collection process comes along that is ripe for standardization - the Department of Labor's (DOL) Form 5500 Annual Report for pension fund data is one such system. The DOL's Employee Benefits Securities Administration (EBSA) recently published a proposal to modernize the data collection process for the annual report and corresponding schedules. The proposal aims to give data users the ability to perform better analysis of individual plans, multi-plan comparisons and trends; aid the agencies efforts at enforcement and at monitoring compliance issues; assist auditors; and provide new research opportunities.

Creating a standardized data collection process can meet these goals as long as the appropriate data standard for financial information is selected and implemented correctly.

Here's how data is collected and processed today

Global pension assets were estimated at $35.4 trillion at the end of 2015, according to a study by Willis Towers Watson. The U.S. has the biggest pension system in the world with 61.5% of global assets and an estimated 806,000 pension and welfare benefits plans reporting.

Pension funds today submit Form 5500 information through the EFAST (ERISA Filing Acceptance System) filing system. Documents are prepared and submitted by fund managers, using either IFILE, a free tool provided by the DOL, or through one of 15 approved products offered by 13 different vendors. EBSA then makes Form 5500 data available as monthly data files in CSV format that can be downloaded by private sector organizations.

The Government Accountability Office (GAO) published a report in 2014 on "Private Pensions, Targeted Reforms Could Improve Usefulness of Form 5500 Information" which identified three key deficiencies in the Form 5500 data collection process:

- Weaknesses in the format (which they defined as inconsistency between how plan asset categories are broken out between government and the investment industry).

- Challenges in finding key information.

- Inconsistent data.

The right financial data standard

The XBRL financial data standard is the most appropriate approach to help EBSA meet its stated goals and to resolve the problems laid out in the GAO report. The most obvious reason is that XBRL is used today to report the same kind of financial information that you find in Form 5500. Every U.S. public company reports financial statements in XBRL format to the Securities and Exchange Commission (SEC), using the US GAAP Financial Reporting Taxonomy, an XBRL digital dictionary maintained by the Financial Accounting Standards Board (FASB) that contains many of the same terms reported in Form 5500 and corresponding schedules.

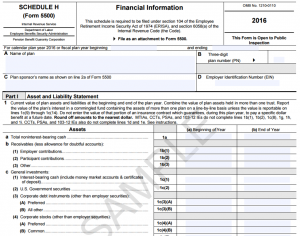

Standardized, clearly defined data items like those on Schedule H shown below are already available and ready for use in the US GAAP Financial Reporting Taxonomy.

Each of the 15,000+ data fields in this taxonomy has associated metadata for definition, balance type and authoritative accounting references; and is structured relative to other elements. When Form 5500 data is created by a pension fund in XBRL format, each datapoint is linked to contextual information such as time period, currency, identity of reporting fund and other descriptors so that whoever is on the receiving end of the data knows the exact meaning of the information.

The XBRL standard is also capable of resolving the issues identified in the GAO report:

Weakness in the format.

Differences in definition between regulators and investors is a big problem. It can be resolved by creating a single, agreed-upon collection of terms called an XBRL taxonomy. Data fields created in XBRL format are required to have associated labels, definitions, units of measure and other descriptive metadata. The XBRL taxonomy structure groups data fields into a hierarchy to explain the relationships between data fields. The taxonomy should be developed through a collaboration between pension fund managers, data intermediaries, investors and the EBSA to agree on the definitions and metadata. The use of a single, periodically updated taxonomy, developed through a collaborative process, ensures that creators and users of the data always reference a single source and the data reported is consistent and understandable by all stakeholders. Only through this level of business and regulatory partnership can the industry be assured that it is communicating consistent, automatable data.

Challenges in finding key information.

Searchability issues can be resolved by using a consistent standard "format" for all data reported. The XBRL format has the appropriate metadata to accommodate the unique features of financial data such as time period and currency. When all values in the Form 5500 and corresponding schedules are reported in XBRL format, the data can be easily extracted and searched, and automatically used, reducing processing cost and increasing timeliness.

In addition, because XBRL is widely used throughout the world, there is a competitive marketplace of real-time data extraction and analysis tools that can be drawn upon to work with the structured pension data.

Inconsistent data.

The GAO report cites naming conventions and identifiers as problematic. This can be corrected by requiring consistent identifiers across reporting organization. Without consistent identifiers, data users must interpret and map the data before they can conduct analysis which is unnecessarily manual, prohibitively expensive and error prone. It is critically important to agree on standardized identification numbers for pension fund data to allow data-sharing across agencies and to the capital markets. The XBRL standard has a means to link to "identifier" components like the LEI (legal entity identifier) and other identifier standards. View this infographic for an explanation of the components of a financial data standard necessary to produce consistent, reliable financial data.

Here's how an XBRL implementation could work

Today, pension funds submit Form 5500 electronically through one of the approved vendor tools. This existing process can be leveraged by working with the approved vendors to adapt to the new standards, mirroring the approach taken by the FDIC where over 8,000 banking institutions submit call report (financial statement) data to the regulator by inputting data to online forms provided by an approved set of software providers. This approach minimizes the learning curve for thousands of pension funds as they can continue following their existing process and even continue using their same vendor. This approach would require the following steps.

- Build a Form 5500 Taxonomy. The US GAAP Financial Reporting Taxonomy should be leveraged as a base and will likely be able to provide the bulk of the data fields needed. Investors, pension funds, regulators, software providers, data providers and any other organizations with a stake in the process should be included in the development process; and a public review should be conducted to capture all possible input. Any data fields not available can be created and added to the existing taxonomy.

- Work with IFILE developers and EBSA approved vendors to adapt their tools to the Form 5500 Taxonomy. As fund managers input data to these forms, the applications can automatically translate the values into XBRL format.

- Ingest pension data received automatically into the EBSA system and post data online for the public. XBRL-enabled databases and analytical tools that are currently used to work with other XBRL implementations, e.g., for public company financials or bank financials as well as numerous non-US programs, can be easily adapted to extract and analyze the XBRL-formatted pension data. Other tools that are not currently "XBRL-enabled" can be easily adapted as well.

Conclusion

Using the right data standard, leveraging existing implementations and taking a well-planned approach will result in standardized data for pension funds that is more timely, consistent, comparable and accurate. An appropriate data standards program can result in cutting unnecessary government spending on data collection and processing; and reduce the burden on those required to report.

Read the XBRL US comment letter to the Department of Labor for more detail on the XBRL standard and how it would work to standardize pension fund data.

One comment on “Pension fund reporting – a process ripe for standardization”

Comments are closed.

The statement “It can be resolved by creating a single, agreed-upon collection of terms called an XBRL taxonomy.” is not as precise as it needs to be. While you do need to agree on terms, it is just as important to agree on the relations between terms. XBRL-based financial filings to the SEC has proven this. The relations need to be correct because if they are not then errors result. If there are errors, the information really is not that useful because the information is not trustworthy.