By Ami Beers, CPA, CGMA, Senior Director, Assurance and Advisory Innovation — Public Accounting, AICPA; and Joan Berg, Toppan Merrill, and Chair, XBRL US Data Quality Committee

The Securities and Exchange Commission (SEC), recently not only acknowledged the value of the validation rules developed and made freely available by the XBRL US Data Quality Committee (DQC), but posted an announcement suggesting the staff is using the rules for their own purposes.

The DQC, which publishes three validation rulesets for corporate issuers every year, is funded by members of the Center for Data Quality which has a mission to improve the usability of XBRL data. Since it was first established in 2015, the DQC has worked closely with the FASB, and later began working with the IASB (when IFRS rules first kicked in) to establish rules that enforce the intended use of the taxonomies. The DQC also meets with the SEC semiannually to keep them informed of newly developed rules, as well as progress made on the error rates in existing filings. Recent developments point to regulatory acceptance of the value and need, for the DQC rules:

DQC Incorporated into US GAAP Taxonomy

In the 2020 release of the US GAAP Taxonomy, the FASB, for the first time, embedded DQC rules in the US GAAP Financial Reporting Taxonomy, and established a process to vet and incorporate rulesets each year.

And on November 4, 2020, the SEC announced that the FASB had added three additional rules to the proposed 2021 XBRL US DQC Rules Taxonomy and Technical Guide, stating, “The SEC staff encourages filers, investors, analysts, software service providers, and other interested parties to participate in this public review to continue to improve the process for creating and using XBRL-structured financial statements.”

Data Quality Committee Referenced in SEC Commissioner Speech

Separately, in her November 17 speech at the XBRL US Investor Forum, SEC Commissioner Allison Herren Lee noted that in addition to the work of the SEC staff and the FASB, she “…commend[s] the work of XBRL’s Data Quality Committee in the development of tools to help enhance accuracy and quality.”

SEC Observes Filing Errors that Match DQC Rule Published July 2020

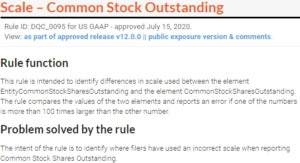

And on November 19, the SEC staff published an announcement pointing out inconsistencies they had observed in XBRL filings that result in scale errors between facts reported for Entity Common Stock Shares Outstanding and Common Stock Shares Outstanding.

The DQC had noted these scale error problems, and published DQC Rule 95 (shown below), back in July of this year. Since then, we’ve been highlighting this problem to issuers who can use the rules through their own XBRL preparation software or through an application on the XBRL US web site. So far, the rule has been triggered by errors 121 times.

We are encouraged by, and appreciate, the acknowledgement and apparent use of the rules by the SEC staff. The more awareness and support for the rules from regulators, standard setters like the FASB and IASB, and other stakeholders, the more issuers will use them. And the more issuers use them, the greater the decline in errors, and the increase in quality of the data produced by issuers in their XBRL filings.

Want to learn more about the rules and the FASB’s process to incorporate them into the US GAAP Taxonomy? Register to attend a free 50-minute webinar on December 3 at 1PM ET, featuring David Shaw, XBRL Supervising Project Manager, Financial Accounting Standards Board (FASB).