By Campbell Pryde, President and CEO, XBRL US

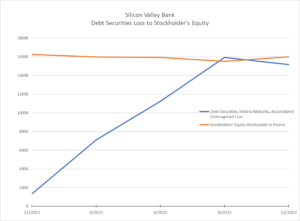

Silicon Valley Bank went bankrupt because it had unrecognized losses on held-to-maturity securities that were greater than the bank’s equity. And the losses started climbing as early as March of 2022 as shown on the graph below. If the bank was forced to sell these securities and thus realize the loss, they would have negative equity.

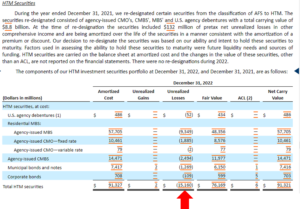

The losses were not reported on the income statement or balance sheet, but they were easily available in the notes to the financials as shown below.

Not only were the losses easy to find, they were conveniently reported in machine-readable (XBRL) format.

The Securities and Exchange Commission (SEC), in a prescient move 14 years ago, mandated the reporting of data in corporate financial statements and footnotes, in fully searchable, machine-readable format (XBRL). While commercial data aggregators have been extracting, databasing, and reselling financial fundamentals for decades, the Commission recognized that by rendering all data machine-readable (not just the fundamentals but also the data points that are often buried in the footnotes), investors could get the complete picture of a company’s financial health.

And just as important, machine-readable data is available faster (within minutes of posting to the SEC’s EDGAR System) and in a concretely understandable format. This improves the ability of data analytics providers to deliver data from all companies, large and small, immediately. It’s possible that some commercial providers today may only extract and serve up data from the face financials, which may be why those illuminating tidbits in the footnotes were missed by many.

Every fact shown on the table in the footnote above, and every fact reported on the face financials, is “XBRL-tagged” which means that it has embedded metadata about the fact (definition, data type, balance type, etc.) that renders it fully searchable and machine-readable. Savvy analysts recognize that everything they need might not be in the financial statements alone.

“If all the values are tagged like they are in XBRL, investors and analysts can create whatever “statements” they want”, noted Eric Linder, President of SavaNet LLC, a financial analysis software company, “By using XBRL, investors and analysts could have easily and automatically created a version of the income statement and balance sheet that included the losses on held-to-maturity securities.”

While some regulators like the SEC, the Federal Deposit Insurance Corporation (FDIC) and the Federal Energy Regulatory Commission (FERC) have already caught on to the wisdom of data standardization (they all require reporting entities to submit financial and other business data disclosures in XBRL format), a recently passed bill aims to expand structured data use even further.

The Financial Data Transparency Act (FDTA) which was signed into law as part of the National Defense Authorization Act of FY 2023 in December of last year, calls for the use of data standards by eight member agencies[1] of the Financial Stability Oversight Council (FSOC). As these agencies explore how to implement this program successfully, we hope they learn from their fellow regulators at the SEC, the FDIC and the FERC. Requiring data to be reported in XBRL format enables the kind of transparency and accountability which are the ultimate goals of the FDTA.