By David Tauriello,

Vice President of Operations, XBRL US

For nearly 15 years, every exchange-listed public company has submitted financial data for quarterly and annual statements and disclosures to the US Securities and Exchange Commission (SEC) using the XBRL Standard. One of the challenges often cited to using this data is that the SEC requirement permits entities to "use a non-standard financial statement line item that is not included in the standard list of tags" - creating extension concepts for reported facts that are not (yet) defined in US GAAP or IFRS base taxonomies. While the use of extensions holds steady at about 19% of concepts across reports annually, today's base taxonomies contain more concepts than ever.

Normalizing financial reports can create improved comparability and transparency. The process involves classifying extensions and consolidating concepts. Most commercial data aggregators and intermediaries dedicate significant resources to the effort because it's a process requiring knowledge of accounting fundamentals and familiarity with the data filed across time.

XBRL US has access to similar resources. As part of our mission to improve financial disclosure, we support the Financial Accounting Standards Board's (FASB) annual US GAAP taxonomy process and coordinate the development of open source rules for filers published by the Data Quality Committee (DQC) - two groups familiar with accounting and SEC data. And the DQC rules are important enough to the process of financial reporting that an increasing number of the more than 150 checks are included in FASB's annual taxonomy AND used during the SEC's EDGAR submission processing.

Our work with FASB and the DQC influenced the creation of a Standardized Statement Taxonomy (XUSSS) for commercial and industrial entities - a set of normalized core concepts represented in a balance sheet, income statement and cash flow statement. Among its benefits, XUSSS can be instructive to the rule creation process. Working with normalized data uncovers outliers and leads to improved understanding of data quality issues in financial reporting.

Here's a fun part

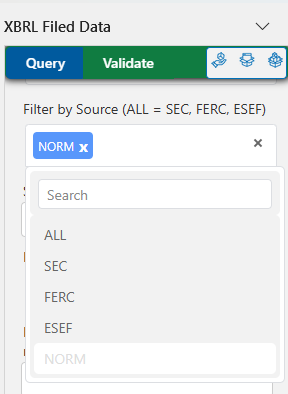

We're using the XUSSS when SEC filings are copied to the Public Filings Database. In addition to copying filings, we now create normalized views of quarterly and annual reports filed with a US GAAP Taxonomy. The filings can be queried using XBRL API endpoints (fact, report, etc.) with filter report.source-name=NORM. To make it easy, we've also added this option to the Filter by Source field of our spreadsheet add-in.

Login here and you can get a JSON list of

the 10 latest reports we've normalized.

More fun - some code to roll your own

The normalization process for the Database uses the XBRL Rules and Query Language (XULE). You can use the Python code in this Jupyter Notebook to start XULE in Arelle, run the normalization routine on any filing using the 2024 US GAAP Taxonomy, and create an XML or JSON output of the report. It's important to note that while the XUSSS is used to create a normalized data set representing US GAAP reporting, the XULE normalization process works with any structured data source regardless of format (so, not just XBRL but also XML, CSV, JSON and maybe someday even PDF/A). The Federal Energy Regulatory Commission (FERC) used a similar approach to standardize 10 years of eForms data in its Visual FoxPro database in the same year the regulator implemented a modernized collection process moving from PDF to XBRL.

Normalized financial data is a valuable tool for regulators, investors, analysts, and other stakeholders making informed decisions about entities. Want to learn more about how to normalize your favorite data sources? Contact info@xbrl.us.