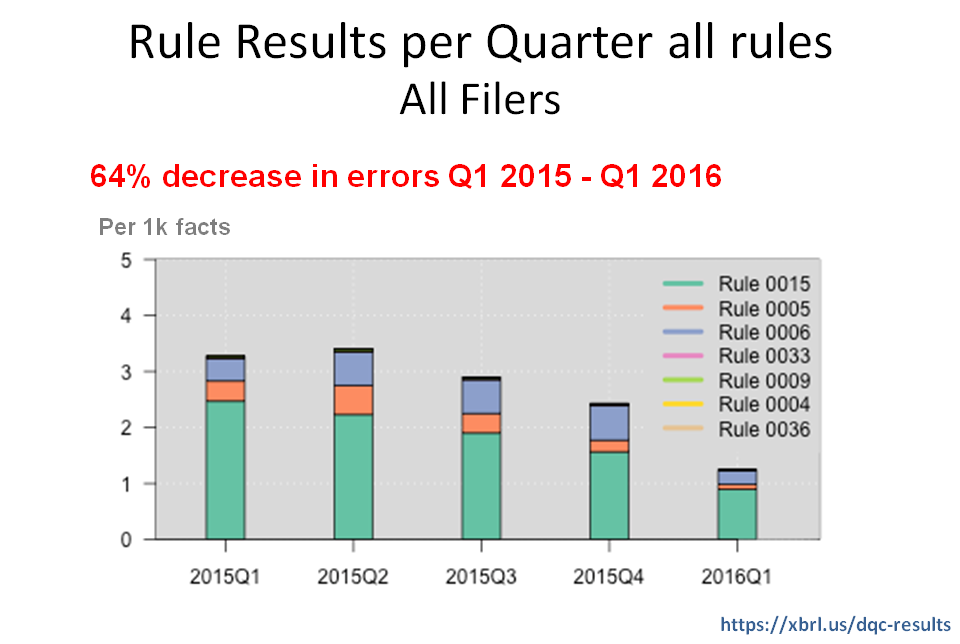

XBRL US Data Quality Committee (DQC) conducted an analysis showing that, overall, by using its first set of validation rules, filers reduced the number of errors in their filings for the data covered by those rules. The chart below shows that errors for all filers were reduced by 64 percent in the first quarter of 2016 as compared to the first quarter of 2015.

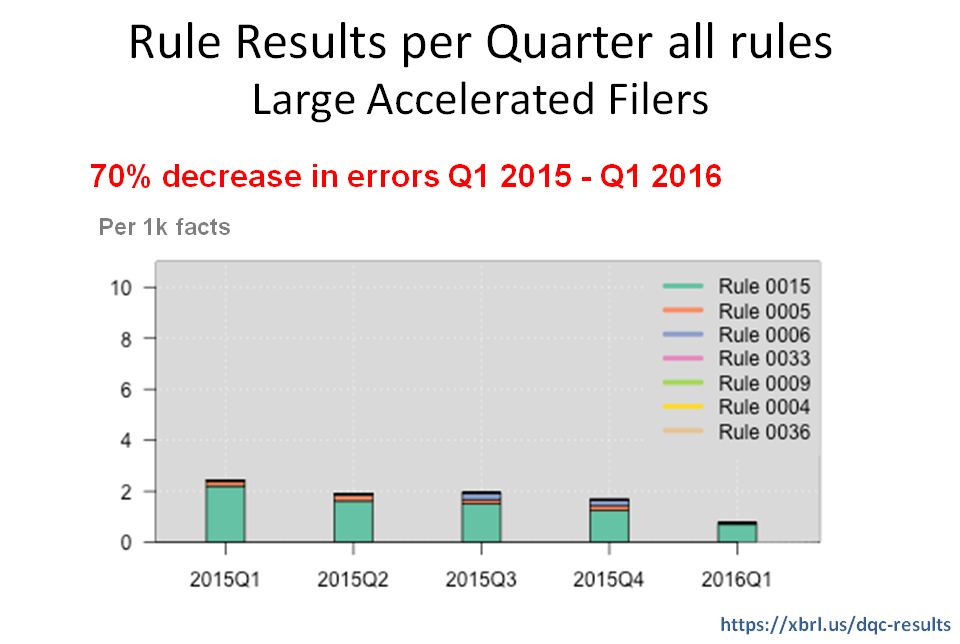

This chart shows results for large accelerated filers which had a 70 percent decrease in the number of errors over the same time period.

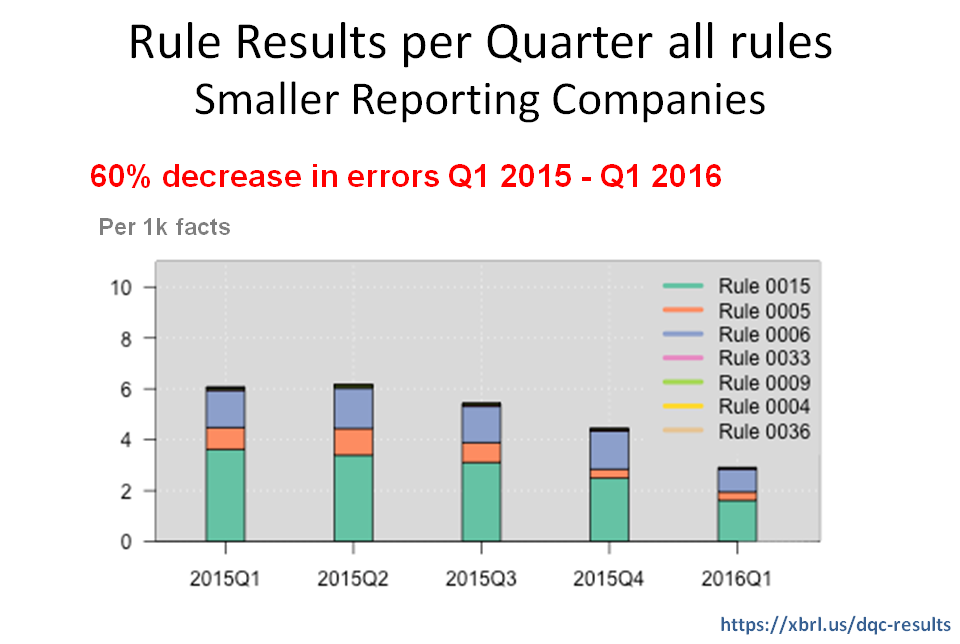

Smaller reporting companies had a 60 percent decrease in the number of errors.

Comment

You must be logged in to post a comment.