Heather Krupa, CPA, Controller at Global Water Resources

If I need to analyze a lot of data, I opt for a spreadsheet, rather than pencil and paper. If I need to combine data from more than one spreadsheet, I use formulas to bring those data points together, rather than cutting and pasting them into a single sheet. If the tool is there, if it is easy and inexpensive to use, why not use it?

It is just common sense.

It may take a few minutes to figure out how best to use a VLOOKUP in Excel or Google sheets, or I may even need to search online for instructions on how to do it most efficiently. But at the end of the day, I know it will save time, probably improve the accuracy of my analysis, and leave me with a routine or two I can re-use later.

That is why so many filers use the open, freely available Data Quality Committee (DQC) rules and guidance to check their XBRL financials. Besides the fact that DQC rules can improve the quality of your financials, there are three additional reasons to make this routine part of your process:

- They are free.

- They are easy to understand.

- They are available everywhere.

For the last few years, filers have been able to access the rules by using a Center for Data Quality Certified software application, or by using the automated tool for checking filings and human-readable reference pages of DQC rules on the XBRL US web site.

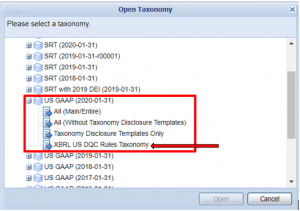

Now, these rules are even more accessible. Starting with the 2020 US GAAP Taxonomy, filers can review the most established rules generating the highest number of errors directly in the FASB’s US GAAP Financial Reporting Taxonomy. You can find them by visiting the FASB Viewer. Just select XBRL US DQC Rules Taxonomy under the drop-down for the US GAAP 2020-01-31 Taxonomy as shown in the diagram below.

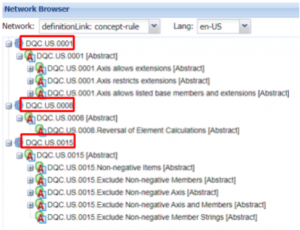

DQC rules for Access with Inappropriate Member (0001), Reversed Calculation (0008), and Negative Value (0015) can be viewed in the concept-rule network browser drop-down as shown below. While all the DQC rules have not yet been incorporated, they will be continually updated as future releases of the taxonomy become available.

The first rule, DQC US 0001, addresses situations where axis have been used with inappropriate members. For example, when reporting a fact that applies only to the Consolidated Entity, preparers should never use the LegalEntityAxis. If the axis is not used, investors, regulators, and other users of your financial data will assume that the data applies to the consolidated entity.

DQC US 008 applies to facts where a calculation relationship in the company’s extension differs from the calculation defined in the US GAAP Taxonomy. For example, the taxonomy defines Stockholders’ Equity Attributable to Parent as a component of Stockholders’ Equity Including Portion Attributable To Noncontrolling Interest; this is because Stockholders’ Equity is comprised of both the portion attributable to the parent and the noncontrolling interest. We have seen cases where an SEC filer changed the calculation relationship so that Stockholders’ Equity Including Portion Attributable To Noncontrolling Interest was a component of Stockholders’ Equity Attributable to Parent. This results in data users misinterpreting the meaning of the company’s data.

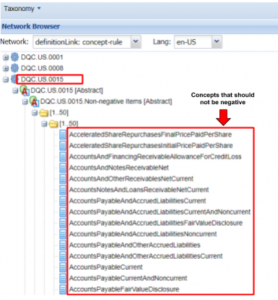

DQC US 0015 is used to alert filers when they have input facts using a negative sign when the fact should have been reported as positive. For example, if an SEC filer reports Accrued Liabilities And Other Liabilities with a value of -400,000, it will cause a lot of confusion among the users of that company’s data. As you can see from the diagram, there are numerous concepts that fall into this category and preparers can now check to see all the concepts in the FASB Viewer.

Errors like these can cause regulators, investors, and analysts - even your own customers or clients, as well as corporate management and employees - to misinterpret your company financials. Inadvertently making these errors happens more often than you might expect, if you do not have the right tools or routines to catch mistakes.

I joined the DQC as a preparer member last year. My fellow committee members are from the AICPA, Bloomberg, Calcbench, the CFA Institute, Credit Suisse, idaciti, S&P Global Capital, and Morningstar, along with filing agents and XBRL application providers, who spend a lot of time working directly with SEC filers. The Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) sit in on our committee meetings as observers because they recognize the importance of giving proper guidance to filers. We take tremendous care in creating the DQC rules to guard against false positives and to ensure that each rule addresses a common, frequently occurring error. We even put the rules out for a public review period to get further feedback from the marketplace.

Errors like the examples described earlier, are real. You can even see these in near-real time by visiting this page. The financials containing these mistakes were submitted to the SEC and are now in the EDGAR database. Data from these filings is being used by investors, regulators, researchers. and securities analysts. In most cases, it takes just a few minutes to check and correct these problems. If the filer had used a DQC-certified application, they would have been alerted to the error.

The DQC rules have been adopted by many of your peers. They are available everywhere, and now are even embedded in the FASB US GAAP Financial Reporting Taxonomy. If you choose a VLOOKUP or other formula for a complex analysis instead of pencil and paper, is there any reason you would not use the DQC rules?

It is that easy.