Success Builds Momentum to Enact Additional Rules and Improve Element Selection Process

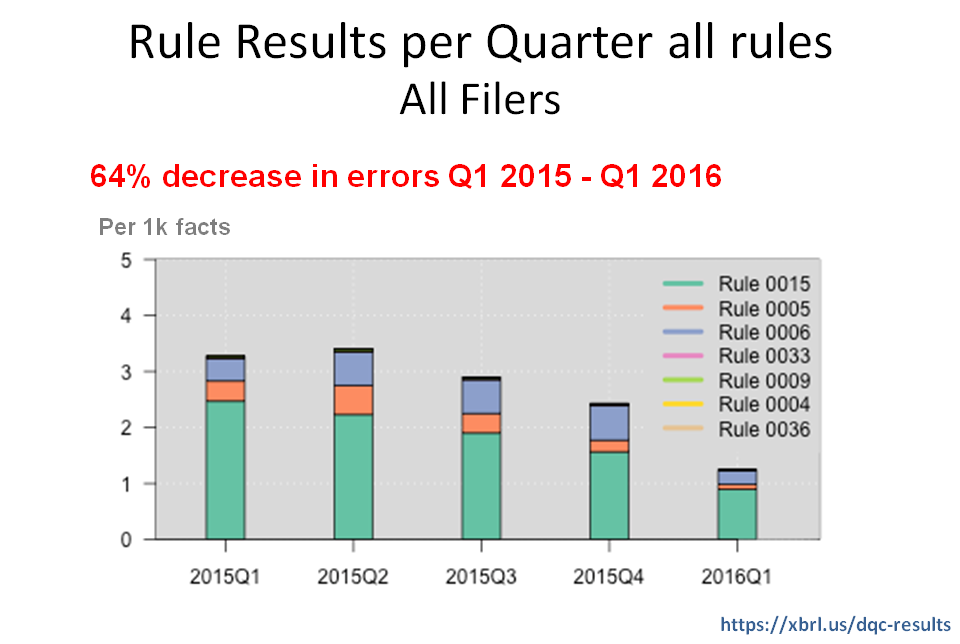

The XBRL US Data Quality Committee (DQC) today announced that overall, by using its first set of validation rules, filers reduced the number of errors in their filings for the data covered by those rules by 64 percent in the first quarter of 2016 as compared to the first quarter of 2015. Large accelerated filers had a 70 percent decrease in the number of errors, while smaller companies had a 60 percent decrease.

The DQC's validation rules – which enabled validation of more than 1.9 million data points in the first quarter of 2016 – are designed to help public companies detect inconsistencies or errors in their XBRL-formatted financial data. The rules identify potential errors (i.e.,incorrect negative values, improper value relationships between elements, and incorrect dates) that impede automated processing and analysis of the data. The DQC approved the rules in November 2015 after a 60-day public review, and they became effective January 1, 2016.

“The early success of the DQC's validation rules in reducing errors is the first step in its mission to improve the usability of XBRL data,” said Mike Starr, Chairman of the DQC. “We expect that as more registrants use these rules, we will see a further decrease in the number of errors in the data covered by the DQC’s rules."

“We’re pleased that we now have clear evidence that filers are actively embracing the new data quality rules. Greater consistency and quality in XBRL-formatted financials significantly improves investor access to financial data,” said Craig Lewis, Professor of Finance, Vanderbilt University, and former SEC Chief Economist.

The DQC will publish a second release of guidance and validation rules for public comment next week. In addition, the DQC plans to issue for public comment a discussion document later in June that will be the first of a series on a proposed framework for element selection and extension use.

"Compliance with the proposed framework would improve the element-selection process, constrain the use of extensions and eliminate unnecessary extensions,” added Starr. “The use of unnecessary extensions has been one of the major reasons that data aggregators and investors have not moved from manual to automated processing and analysis of XBRL data."

The rules are freely available and can be accessed on the XBRL US web site or through certain XBRL service providers. When the rules identify a potential error, they provide detailed information on the potential error with guidance on how to correct it. In addition, an explanation of each rule’s function is available on the XBRL US website in a downloadable PDF file. Software providers can have their implementation of the rules approved by the XBRL US Center for Data Quality.

To view results of the analysis, go to: https://xbrl.us/data-quality/dqc-results/

To access the rules, go to: https://xbrl.us/data-quality/rules-guidance.

The XBRL US Center for Data Quality provides funding for the Data Quality Committee. Members of the Center include Altova, the American Institute of CPAs (AICPA), Certent, DataTracks, DisclosureNet, Merrill Corporation, P3 Data Systems, Vintage, a division of PR Newswire, and Workiva.