Mike Starr, Chair, XBRL US Data Quality Committee; Vice President, Governmental and Regulatory Affairs, Workiva

As we begin a brand new year, it’s always good to make a few resolutions that go beyond joining a health club, eating right and losing weight. So we have three recommendations to add to your list of resolutions. The first is get involved in industry efforts to improve the usability of XBRL data submitted to the SEC. It won’t require a lot of effort and you will receive some important benefits. For a small investment of your time, you will be on the forefront of imminent, groundbreaking regulatory changes, and you will be able to reduce your workload while significantly improving the quality of your XBRL financial data submitted to the SEC.

Sound too good to be true? Here’s how.

1. Be prepared for regulatory changes and submit your filing using the Inline XBRL standard

Inline XBRL is a twist on XBRL that essentially embeds the XBRL into the HTML version of your filing. Last June, the Securities and Exchange Commission (SEC) issued an exemptive order allowing public companies to file using Inline XBRL, replacing their existing dual-filing requirement with just the single Inline XBRL file. The goal of the program is to reduce the workload on corporate filers because they only need to create a single document.

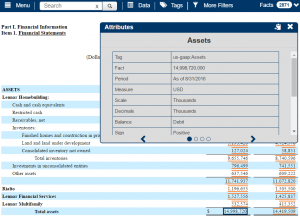

The other big benefit of Inline is that it makes it much easier for filers to review their own documents because they can check the HTML filing and track individual values back to the XBRL concept chosen, with all associated attributes such as time period, definition, scale, etc., easily discoverable. The image below shows a nifty viewing tool the SEC created that lets visitors click on values like the Assets figure highlighted below (14,998,720,000) and find all the associated descriptors.

The SEC viewer is only available for filings that have already been submitted to the SEC, but the Commission has made the code to the viewer open source so XBRL creation and analytics providers can grab the code and create their own versions.

Since this is a voluntary program that is just getting started, only about 30 companies have submitted filings using Inline XBRL to date. But most XBRL tool and service providers have been busy adapting their offerings to work with the Inline XBRL specification so there are many providers who can help you do this yourself.

Why be a trailblazer? Because past experience shows that when the SEC initiates a voluntary program, it’s only a matter of time before an actual rule proposal for mandatory filings comes about. Getting up the learning curve today makes sense if Inline XBRL is the future for financial reporting. We think it is.

2. Improve the quality of your filings by taking advantage of free XBRL Data Quality Committee (DQC) rules and guidance

If you are not yet using these freely available validation rules, you owe it to yourself and your company to do so with your next filing. The "DQC" is a committee comprised of investors, data providers, research analysts, accountants and XBRL tool and service providers, that took it upon themselves to help all registrants produce more consistent filings.

They realized that because there wasn’t an easy, standard way to validate their XBRL data, registrants sometimes had difficulty determining whether there were any errors or inconsistencies in XBRL data, e.g., which XBRL concepts should always be positive and which elements conflict with another XBRL element. They knew that the vast majority of registrants want to produce consistent, useable data in their XBRL filing.

Since the committee first convened in 2015, they've conducted an open and transparent process to develop rules which includes conducting public reviews and accepting comments. Their work has published rules that have resulted in over a 66% improvement in the data that the rules cover. These rules automatically check for common problems such as negative values that should be positive, axis/member combinations that conflict, deprecated data fields and relationships between elements that shouldn't exist. The latest two sets of new rules were published in November 2016 and January 2017, and all rules can be found here.

By the way, the new rules, if employed, will result in a further, significant improvement in the quality of XBRL data submitted to the SEC. It is also important to note that the DQC has regularly scheduled meetings with SEC staff from the Divisions of Corporation Finance and Economic and Risk Analysis and the SEC staff monitor the impact of the DQC's rules.

Many tool and service providers have built these rules into their offerings and received a certification from XBRL US that their incorporation complies with the rules issued by the DQC. Certified software is available from several XBRL US Members. You should check with your provider to find out if their software has been certified to be compliant with the DQC's rules. If they have not incorporated the rules, you can still run the rules yourself using a free tool that XBRL US has made available on their site. The rules generate a report that shows you what changes you need to make to your XBRL document before submitting it to the SEC.

There's no reason for any filer to not use these rules. They're free and even if you find that you have no errors, you'll get the peace of mind of knowing you've produced a good quality filing.

3. Take an active role in improving the quality of XBRL data - weigh in on the DQC rules in proposal stage.

If you're not familiar with the Data Quality Committee, it's worth taking the time to understand their process. The committee builds sets of validation rules, tests them internally, then publishes them for a 60 day public review period. The purpose of the review period is to get more feedback from the market which can include data providers, SEC filers, investors, analysts and even regulators. Every comment received is individually reviewed by the committee and then, if merited, incorporated into the final rules that are published.

We strongly encourage you to review the rules when in proposal stage as well as those rules that have already been published. Let the committee know if you have any exception that they may not have considered in their rulemaking process. Tell them if there's another situation you think they should consider or if the messages published in the error report that filers receive need further clarification. The goal of the DQC rules for issuers is consistency, consistency, consistency. The more people using the rules and weighing in on their creation, the better they'll be. And the better the data that issuers will be able to provide to their investors, to regulators and any other stakeholders.

So Happy New Year fellow accountants! There's an exciting year ahead and we hope you'll adopt our three resolutions for 2017.