Rule function

This rule evaluates whether a calculation relationship in the company’s extension is a reversal of the calculation defined in the base taxonomy used for the filing. The rule checks if the element representing the calculation total and the element representing the component are a reversal of those same elements defined in the base taxonomy with the same calculation weight.

This rule only compares the defined relationship between two elements joined by a single calculation arc in a company’s calculation relationship and checks if the opposite of that relationship exists in the base taxonomy. Both elements in the calculation relationship must have a balance attribute of either debit or credit.

Basis for rule

The EDGAR Filer Manual – https://www.sec.gov/info/edgar/edmanuals.htm – requires that companies include a calculation linkbase for all calculations expressed in the filing. The calculation in the XBRL filing must match that represented in the companies non XBRL filing.

Problem solved by the rule

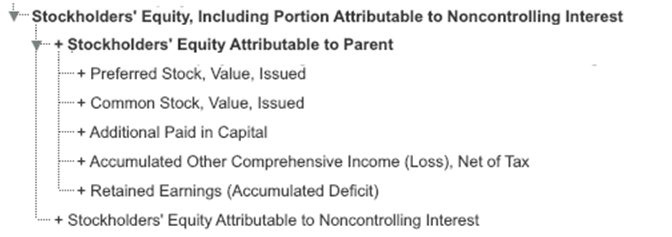

Users expect that the calculation relationships defined between elements in the base taxonomy can be used to identify the meaning of an element. For example when reporting using the US GAAP Taxonomy, Stockholders’ Equity Attributable to Parent is a component of Stockholders Equity Including Portion Attributable To Noncontrolling Interest as Stockholders Equity is comprised of both the portion attributable to the parent and the noncontrolling interest.

However, if the company changed the calculation relationship so that Stockholders Equity Including Portion Attributable To Noncontrolling Interest was a component of Stockholders’ Equity Attributable to Parent then a user of the data will have a different meaning of the concept of that reported by the preparer.

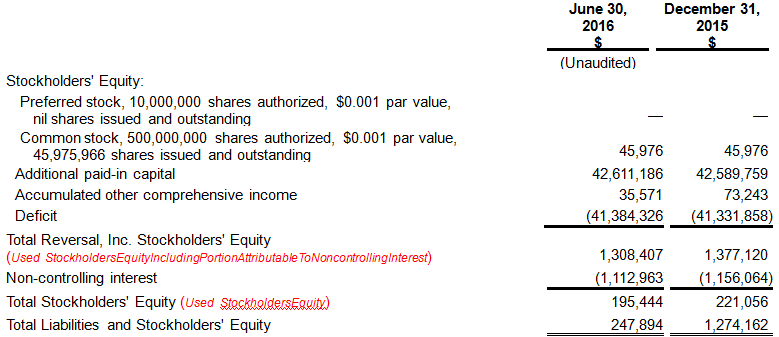

The disclosure below shows where the incorrect elements were selected and the calculation was reversed to make the calculation work.

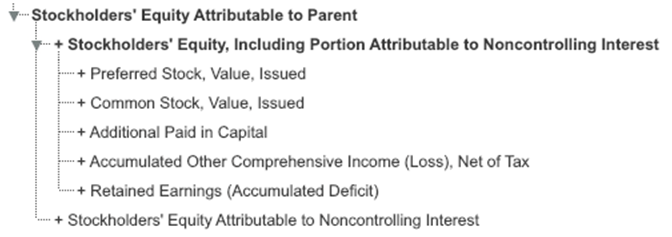

The following diagram shows the incorrect tree created by the filer.

The correct tree should be as follows:

Example rule message

(Note: Presentation style of rule messages may differ among software implementations of the rules.)

The calculation in the extension taxonomy shows Stockholders Equity Including Portion Attributable To Noncontrolling Interest as a calculation component of Stockholders’ Equity Attributable to Parent in the network for the balance sheet. This is the opposite of a calculation defined in the base taxonomy. Check that the calculation is correct or that you have used the correct tag for the two elements identified in the calculation.

Rule version: 4.0

For Developers

The Global Rule Logic document contains general guidelines for implementation of rules.

The rule message template contains text and parametric reference to arguments of the rule operation, using the syntax ${parameter} to indicate that insertion of a parameter’s value is to occur.

Message template

The calculation in the extension taxonomy shows ${extCalcTargetName} as a calculation component of ${extCalcSourceName} in the network for the ${networkName}. This is the opposite of a calculation defined in the base US GAAP taxonomy. Check that the calculation is correct or that you have used the correct tag for the two elements identified in the calculation.

Rule version: ${ruleVersion}

Rule element ID index

The rule element id is used to identify unique elements or combinations of elements tested in the rule.

| Rule element ID | Element label | Element name |

|---|---|---|

| DQC.US.0008.6819 | All | All |

View: as part of public exposure version v6.0.0RC2 || Return to current approved version.