This guidance supersedes the prior guidance “XBRL US Best Practices/Data Quality Working Group- 2.1.5 Multiple Dividends Declared and Paid”. Filers are encouraged to modify their tagging following the approach outlined in the new guidance.

This guidance is intended to unify the dividends disclosures between reporting textual disclosures of a dividend event, schedules of dividends paid, the Cash Flow statement, the Statement of Financial Position , the Income Statement and the Statement of Shareholders Equity.

This enables easier checking of disclosures, improved quality and consistency of data and improved ease of tagging.

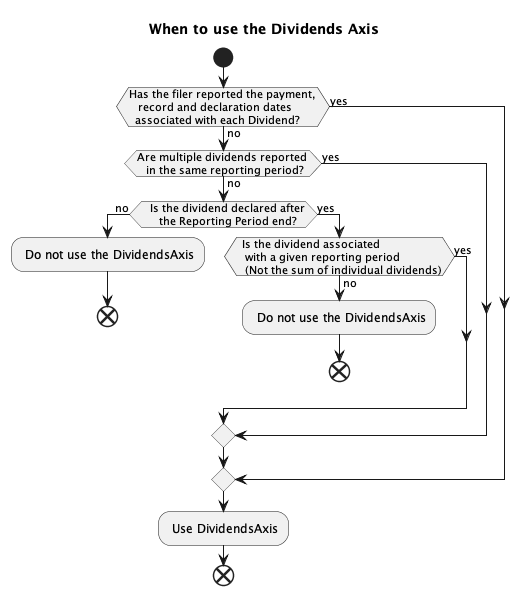

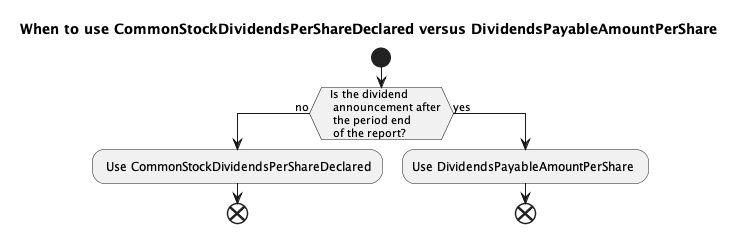

1.1 When should I use the dividend axis?

The DividendsAxis should be used when reporting record date, payment date and declaration date associated with the dividend amount. The DividendsAxis should also be used when there are multiple dividends reported in the same reporting period (for disaggregation). Filers should also use the DividendsAxis, if the dividend is declared after the reporting period and the dividend can be associated with a particular reporting period. However, the DividendsAxis is not needed if the dividend declared after the reporting period is the annual total of several individual dividends to be paid in the next fiscal period. Examples in section 2.2 and 3.2 of this guidance illustrate the scenarios where DividendsAxis should or should not be used.

Figure 1

1.2 How should members be named on the DividendsAxis?

Use the following format for regular quarterly dividends R2024Q1Member.

Use the following format for semi-annual dividends R2024H1Member.

Use the following format for annual dividends R2023Amember.

For special dividends use S2024Member.

The syntax that should be followed for the dividend member is as follows:

- Dividend type: Values of either “R” or “S”. A value of “R” represents regular dividends and “S” represents special dividends.

- Year: Represented using 4 numerical values

- Period: The period is represented using either Q1, Q2, Q3, Q4, H1, H2, M1, M2, M3 to M13 or the value A for annual dividends.

- Optional alpha characters: This is used to capture additional info to disaggregate the dividend member such as warrant and non warrant portion of dividend (Do not use for different classes of stock as the class of stock axis should be used).

- Include the word "Dividends"

- Member: The end of the member name must include the string “Member”

Examples:

O2025Q3DividendsMember: A regular quarterly dividend for Q3 in 2025.

O2026ADividendsMember: An annual dividend for 2026.

Additional number/character may be added, if there are multiple dividends declared in the same quarter/month. For example, O2022Q11DividendsMember, O2022Q112DividendsMember, and O2022Q113DividendsMember can be created, if there are 3 separate ordinary dividend events in Q1 2022 for the same class of stock.

Use Class of Stock [Axis] to disaggregate dividends for different classes of stock.

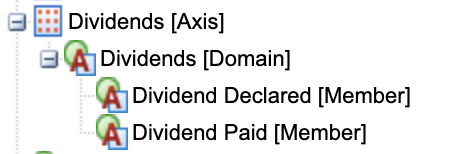

1.3 When should the members (Dividend Declared [Member] and Dividend Paid [Member]) be used?

The US GAAP taxonomy includes the members Dividend Declared [Member] and Dividend Paid [Member].

In the disclosure below these members may seem to be a reasonable way to tag the data. However, the more appropriate approach is to tag the values in each of the columns using the specific dividend elements (see detail tagging in 3.2, Example 4). These members should not be used.

1.4 Should the record date, payment date and declaration date associated with the dividend amount be tagged?

The SEC makes the tagging of dates voluntary, but it is recommended that dividend dates are tagged to get the advantage of having more effective validation of your filing and that these dates are critical for investors.

1.5 What context should be used to tag the record date, payment date and declaration date associated with a dividend announcement?

All dividend dates reported should be tagged with a unique member (such as R2023Q1Member) on the DividendsAxis. The date context period should align to the date context used for tagging CommonStockDividendsPerShareDeclared/ PreferredStockDividendsPerShareDeclared).

In a subsequent event disclosure, when the dividend ‘payable’ elements are used (instead of CommonStockDividendsPerShareDeclared/ PreferredStockDividendsPerShareDeclared), the date content would be the duration from the period-end to the declared date (see section 2.2, Example 1 and Example 2).

2.1 When are the DividendsPayableAmountPerShare and DividendsPayableCurrent used (or DividendsPayableCurrentAndNoncurrent for an unclassified Balance Sheet)?

It is recommended that the dividend ‘payable’ elements (as they relate to a specific dividend event) only be used to report the dividends declared after the reporting period ends. These elements are instant period type and the value reported should reflect the value of dividends payable (per share or dollar amount) at a given point in time. DividendsPayableCurrent and DividendsPayableCurrentAndNoncurrent should still be used to report the dividends payable appearing on the balance sheet.

If the dividends announced are associated with one particular future reporting period, and/or also report record dates/payment dates, the DividendsAxis with unique member(s) associated with the dividends should be used to tag the numeric and non-numeric information (see 2.2, Example 1). If the amount reported is a sum of multiple dividends, a member on the DividendsAxis is not needed (see 2.2, Example 2).

The date context when using these ‘payable’ elements should be the dividend declaration date (instant).

2.2 What date context and element should I use to tag the details of dividends declared after the period year end?

Example 1: (For annual reporting period end of 12/31/2022)

On February 15, 2023, the Company announced that its Board of Directors approved a quarterly dividend of $0.20 per share on all outstanding shares of common stock, which is payable on March 15, 2023, to stockholders of record at the close of business on March 1, 2023.

The value of dividends declared ($0.20) after the period end should use the element DividendsPayableAmountPerShare and should have a date that corresponds to the declared date (02/15/2023), together with a unique member (R2023Q1Member) on the DividendsAxis because the dividend can be associated with a particular reporting period (Q1 2023).

While the SEC makes the tagging of dates voluntary, it is recommended that dividend dates are tagged, as these dates are critical for investors.

In this example, filers can also tag DividendsPayableDateDeclaredDayMonthAndYear (value 2023-02-15), DividendsPayableDateOfRecordDayMonthAndYear (value 2023-03-01) and DividendPayableDateToBePaidDayMonthAndYear (value 2023-03-15), with the duration from the period-end date to the declared date. The date values need to be tagged with the R2023Q1Member on the DividendsAxis.

Values reported should include the subsequent event axis if they are disclosed as a subsequent event.

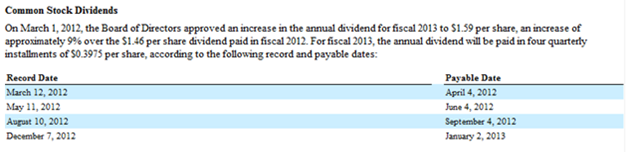

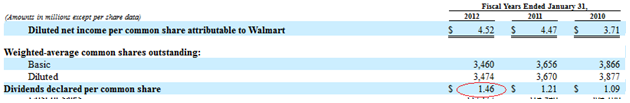

Example 2: (For annual reporting period end of 1/31/2012)

The value of $1.59 would be tagged with element DividendsPayableAmountPerShare with the date March 1, 2012. This would not have a dividend member as it represents the sum of 4 dividends. The value of $0.3975 is tagged 4 times using the element DividendsPayableAmountPerShare. The DividendsAxis should be used to separate these 4 values with unique members (R2013Q1Member, R2013Q2Member, R2013Q3Member, and R2013Q4Member) that are specific to the dividend. The date context should be the declaration date (March 1, 2012).

Filers can also tag dividend dates (DividendsPayableDateOfRecordDayMonthAndYear and DividendPayableDateToBePaidDayMonthAndYear), with the duration from the period-end date to the declared date. The date values should be tagged with the 4 unique members on the DividendsAxis.

The value $1.46 is tagged with the element CommonStockDividendsPerShareDeclared as it represents the expense per share. The context period should be 12 months ended January 31, 2012. The DividendsAxis should not be used for the value $1.46 (see 3.1 and 3.2).

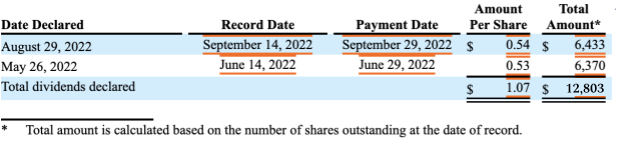

3.1 When should CommonStockDividendsPerShareDeclared versus DividendsPayableAmountPerShare be used?

Figure 3

3.2 When and how is CommonStockDividendsPerShareDeclared (per share amount) and DividendsCommonStock (total dollar amount) used?

These elements are used in most disclosures, except for dividends declared after the reporting period ends (see 2.1 and 3.1).

The value of CommonStockDividendsPerShareDeclared represents the DividendsExpense for the period divided by the number of shares. The date context period should equal the period where the dividend expense was recognized. This allows the comparison to other metrics such as earnings per share and to check if the CommonStockDividendsPerShareDeclared matches the dividend expense recognized in the period.

The individual dividends can be tagged to different context dates, matching dividend expense recognized in the period, therefore, use of unique members on the DividendsAxis is not always required (unless there are multiple dividends in the same reporting period and the axis is required for disaggregation). However, most disclosures also present the record, payment and declaration dates associated with the dividend amount, and it is recommended that filers should tag these dates (see 1.4). Since unique members on DividendsAxis are required when tagging the dividend dates (see 1.5), the numeric values (per share or total dollar amount) should also be tagged to the corresponding members to group all information associated with each dividend declaration together.

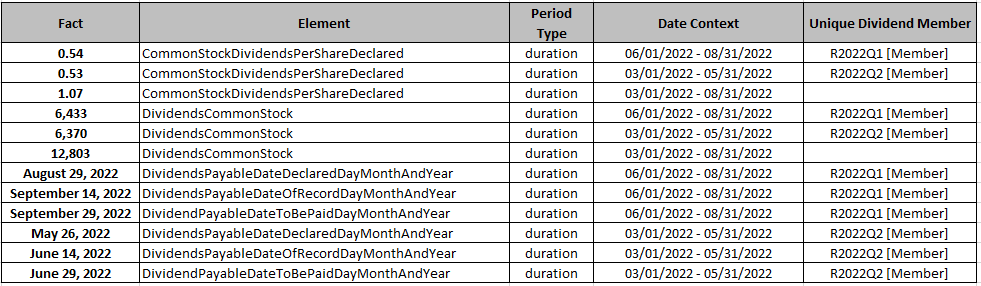

Example 1: (For Q2 reporting period end of 8/31/2022)

Figure 4

In this example, while the individual dividends ($0.54 and $0.53, or $6,433 and $$6,370) can be tagged to different context dates matching dividend expense recognized in the Q1 and Q2 period (without the use of unique members), it is recommended that filers should tag the dividend dates (see 1.4). Unique members on DividendsAxis are required when tagging the dividend dates (see 1.5), so we also tag the numeric values (per share or total dollar amount) to the corresponding members to group all information associated with each dividend declaration together. The date context for non-numeric facts should align to the period used for tagging CommonStockDividendsPerShareDeclared.

The element DividendsCommonStock (representing paid and unpaid dividend) is used to tag the “Total Amount” column in this example, because the Q2 dividends remained unpaid at the end of the 8/31/2022 reporting period.

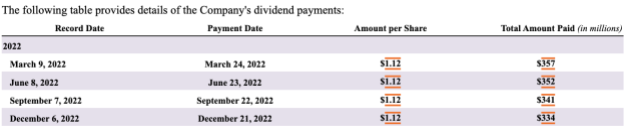

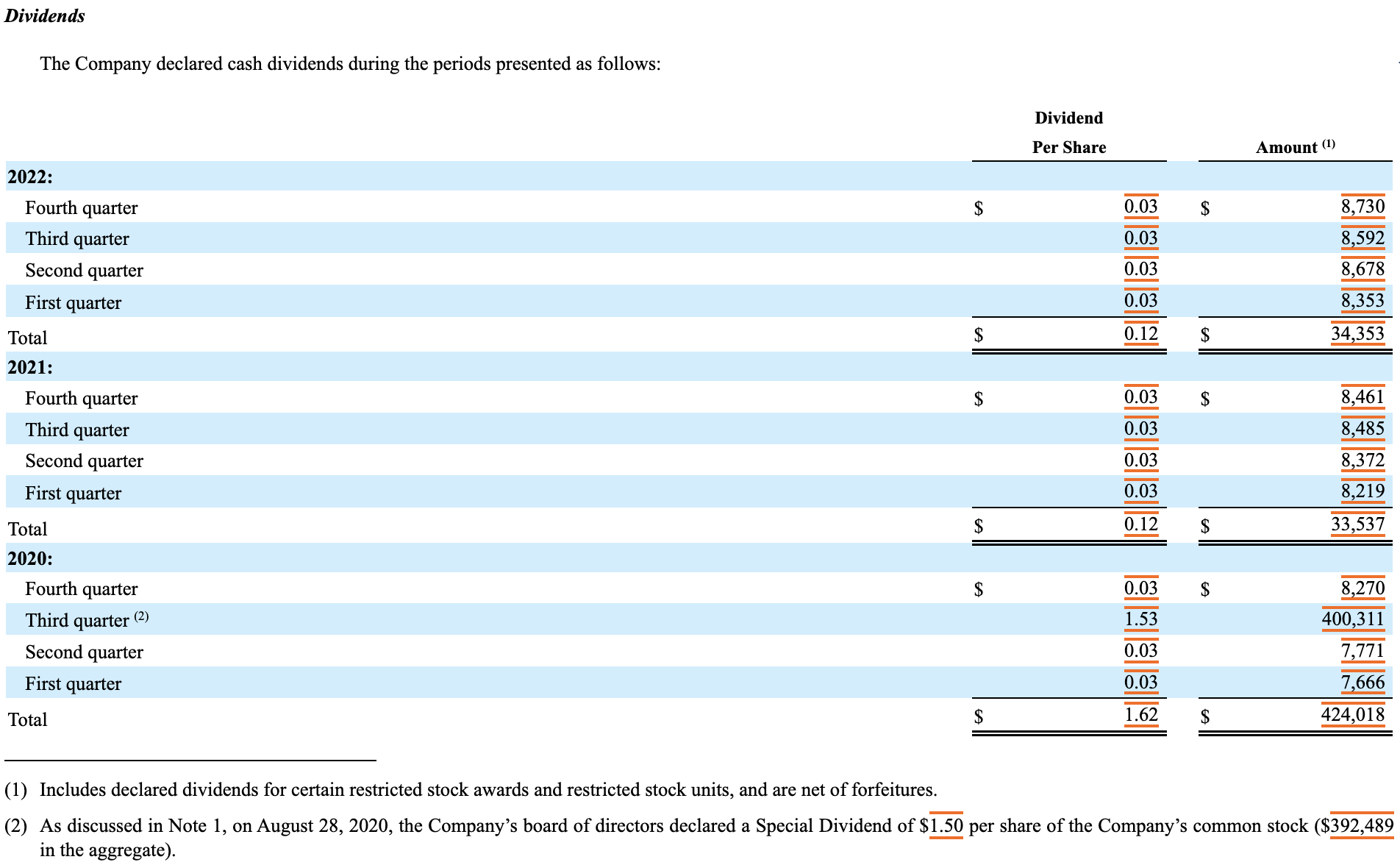

Example 2: (For annual reporting period end of 12/31/2022)

In this example, the dividends per share value of $1.12 should be reported using the element CommonStockDividendsPerShareDeclared, and the value for total amount paid should use the element PaymentsOfDividendsCommonStock. The values should be tagged to the period context for the period in which the dividend expense was recognized, and the payment was made (i.e., Q1, Q2, Q3, Q4).

While the individual dividend values can be tagged to different context dates without the use of unique members, it is recommended that filers should tag the Record Date and Payment Date (see 1.4). Unique members on DividendsAxis are required when tagging the dividend dates (see 1.5), so we also tag the numeric values (per share or total dollar amount) to the corresponding members to group all information associated with each dividend declaration together. The date context for these non-numeric facts should align to the period used for tagging CommonStockDividendsPerShareDeclared.

The element PaymentsOfDividendsCommonStock (representing paid dividend) is used to tag the “Total Amount Paid” column in this example, because all dividends were paid before the end of the 12/31/2022 reporting period.

Example 3: (For annual reporting period end of 12/31/2022)

In this example, the values of the two columns would be tagged using the elements CommonStockDividendsPerShareDeclared and DividendsCommonStock. There is no dividend date information associated with the dividend announcement. These individual dividends can be tagged (without the use of unique members on the DividendsAxis) to different context dates matching dividend expenses recognized in the period (Q1, Q2, Q3, Q4, and Annual).

The element DividendsCommonStock (representing paid and unpaid dividend) is used to tag the “Amount” column in this example, because it is unclear whether all dividends have been paid at the end of the 12/31/2022 reporting period.

However, in 2020 a special dividend was declared of $1.50. This value would require the use of the DividendsAxis to distinguish it from the value of $1.53 in the 3rd quarter of 2020. The value of $1.53 would not use the DividendsAxis but the values of $1.50 and $392,489 would. These values would use the member S2020Q3Member.

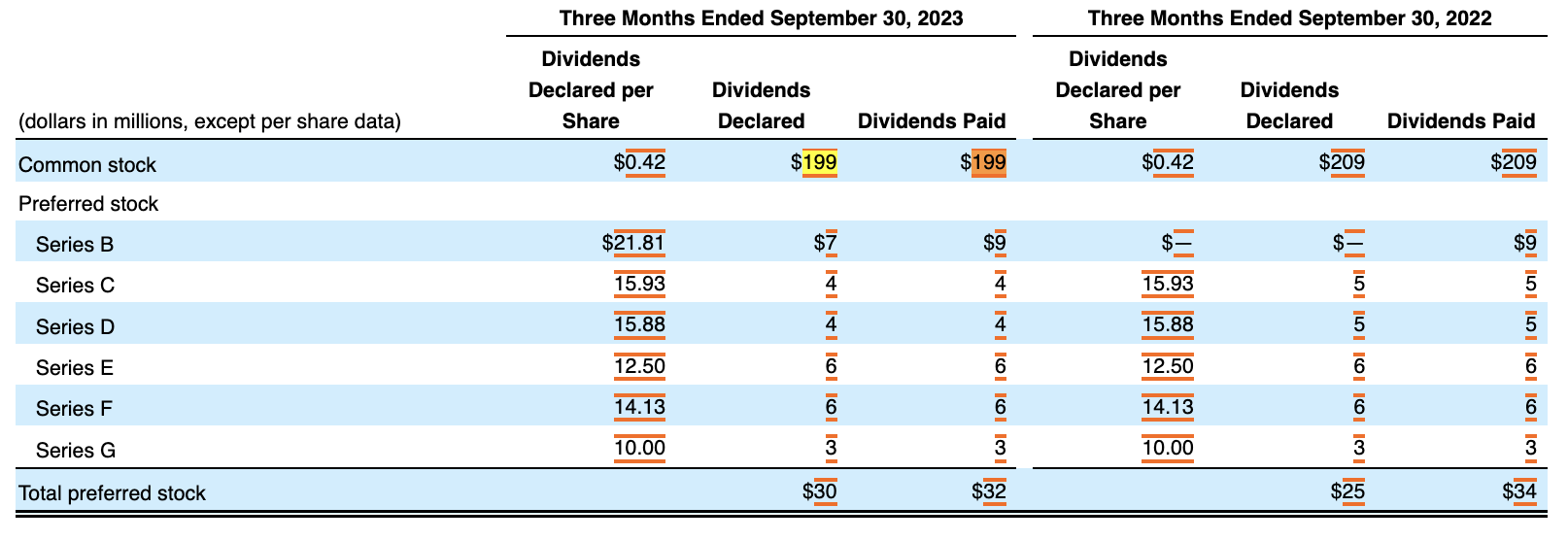

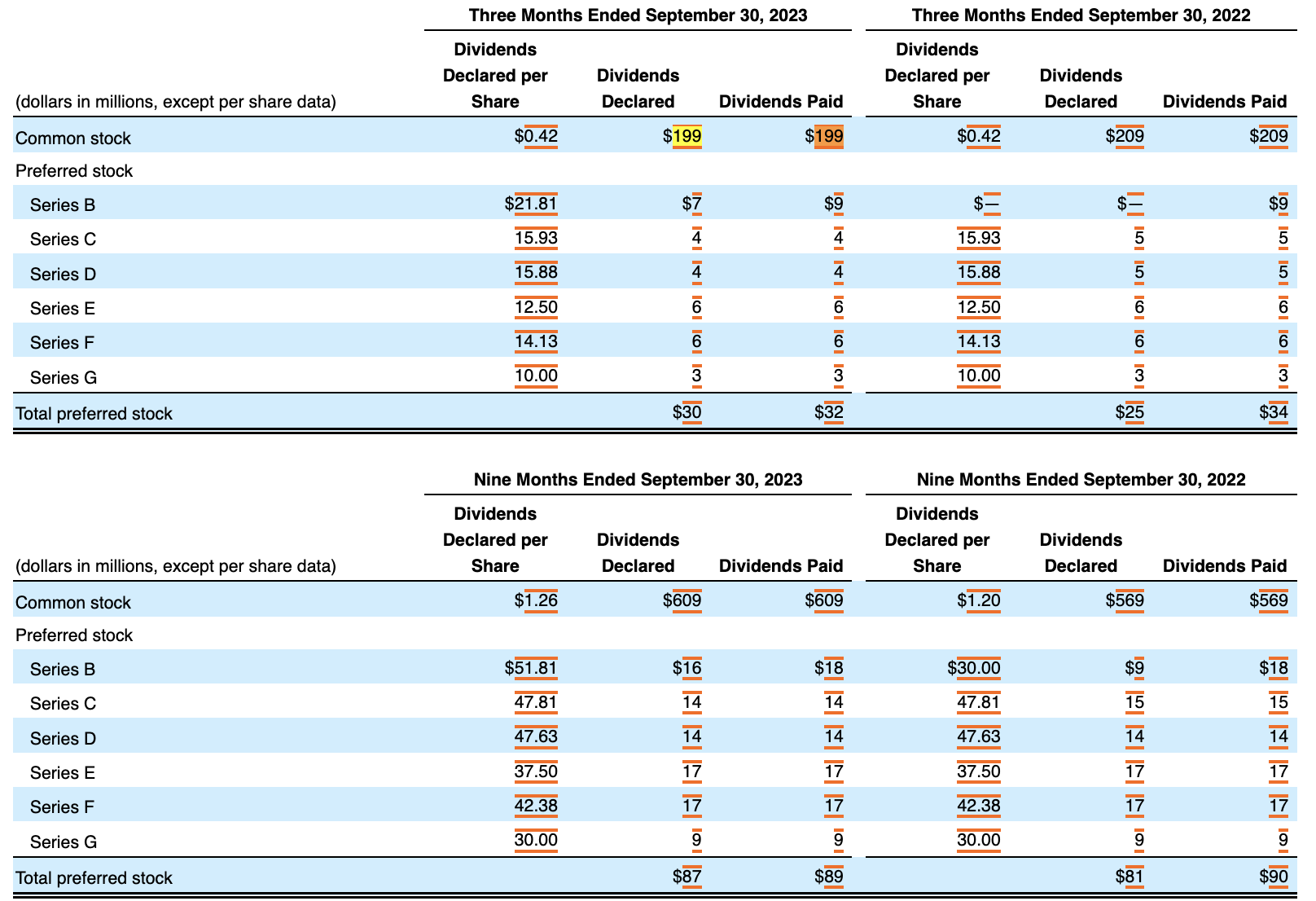

Example 4: (For Q3 reporting period end of 09/30/2023)

In this example, the first column should be tagged with the elements CommonStockDividendsPerShareDeclared and PreferredStockDividendsPerShareDeclared. If the dividends are paid entirely in cash and are the same amount then the elements CommonStockDividendsPerShareCashPaid and PreferredStockDividendsPerShareCashPaid could be used. The PreferredStockDividendsPerShareDeclared elements should be disaggregated using the ClassOfStockAxis.

The second column showing “Dividends Declared” should use the elements DividendsCommonStock and DividendsPreferredStock or the more specific elements CashDividendsCommonStockCash and DividendsPreferredStockCash for each class of preferred stock.

The third column representing “Dividends Paid” should have used the elements PaymentsOfDividendsCommonStock for the payments of dividends for common stock and PaymentsOfDividendsPreferredStockAndPreferenceStock for preferred stock with the ClassOfStockAxis. The context of the periods should have been 3 months for the top schedule and nine months for the bottom schedule. Do not use the two standard members (Dividend Declared [Member] and Dividend Paid [Member]) on the DividendAxis (see 1.3).

Note that the DividendsAxis is not used for this disclosure. When dividend disclosures are not associated with a specific dividend event then the DividendsAxis is not used.

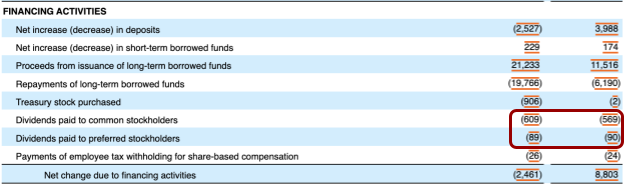

The use of these elements then correspond to the disclosure on the cash flow statement:

The values for $609 and $89 tie back to the values in the dividend schedule. This means the same values are tagged with the same element and the same context.

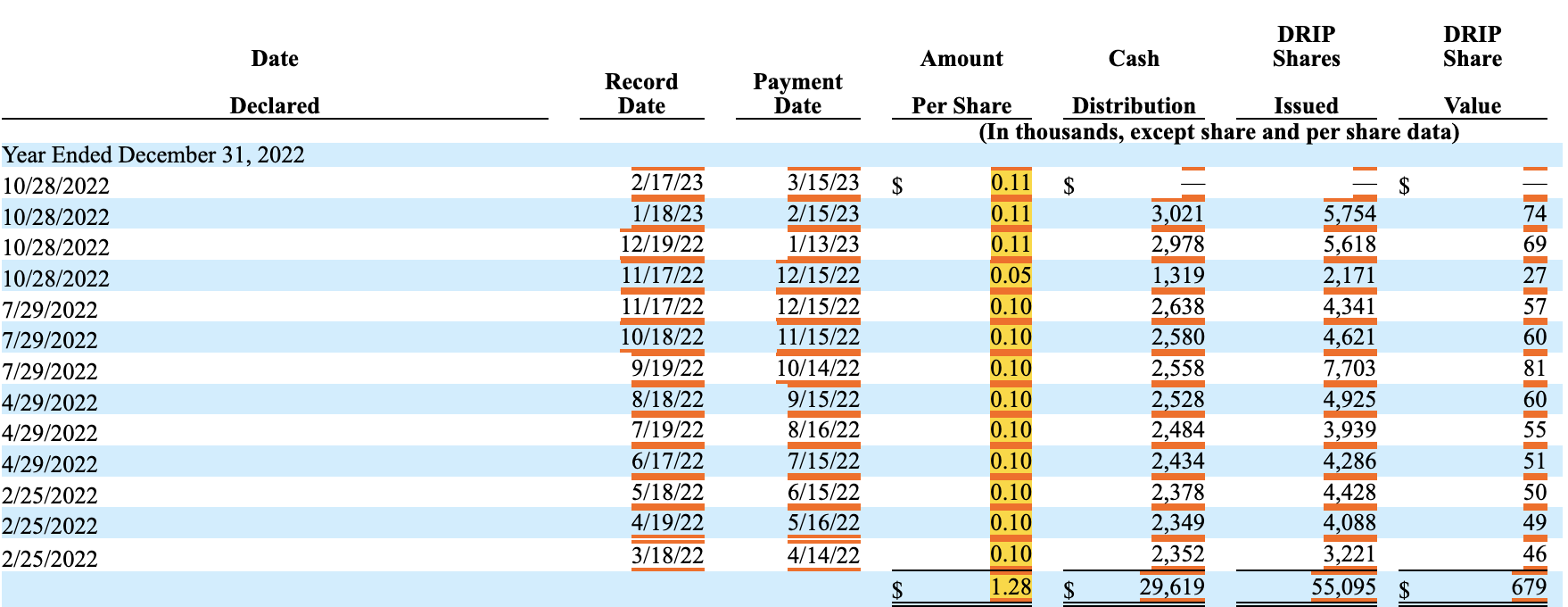

Example 5: (For annual reporting period end of 12/31/2022)

In this example, we use the element CommonStockDividendsPerShareDeclared. There are multiple dividends reported in the same filing period (annual reporting period) and the expense period (Q1, Q2, Q3, or Q4) for each dividend is not clearly presented. The period context of each dividend amount should be tagged with a 12-month period and is disaggregated using the DividendsAxis.

It is recommended that filers should tag the dividend dates (see 1.4). Unique members on DividendsAxis are required when tagging the Declared Date and Record Date (see 1.5), so we also tag the numeric values (per share) to the corresponding members to group all information associated with each dividend declaration together. The date context for these non-numeric facts should align to the period used for tagging CommonStockDividendsPerShareDeclared.

4.1 What elements should be used to report dividends declared per share, reported in the income statement?

The element CommonStockDividendsPerShareDeclared with the period context aligning to each fiscal year is used.

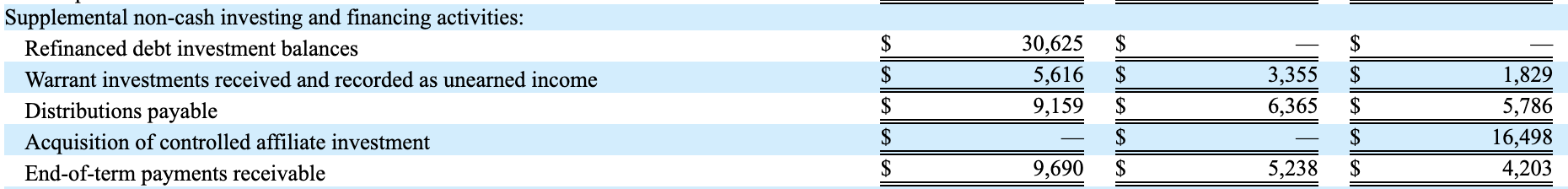

4.2 What element should be used to report dividends or distributions payable in the supplemental section of the cash flow statement?

The element DividendsPayableCurrent (DividendsPayableCurrentAndNoncurrent for unclassified balance sheet) should be used to report Distributions payable ($9,159). In the case of investment companies the element DistributionPayable could also be used if it includes distributions other than dividends. Companies should not create extensions for this element that are a duration. The amount reported in the cash flow statement should correspond to the value reported on the balance sheet.

4.3 What element should be used if dividends are paid out of additional paid in capital?

In some cases, filers pay dividends when there is insufficient funds in retained earnings to cover the distribution. Filers should use the element AdjustmentsToAdditionalPaidInCapitalDividendsInExcessOfRetainedEarnings instead of a regular dividend element like DividendsCommonStock or DividendsCommonStockCash.

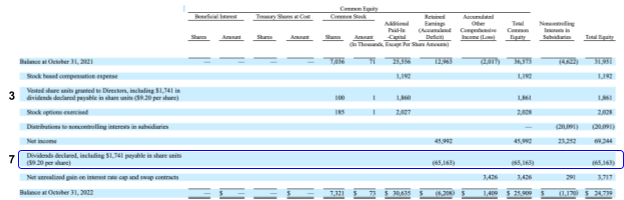

4.4 How are combined cash and stock dividends represented in the Statement of Changes in Shareholders Equity?

In this example, the value of dividends declared on line 7 represents dividends that will be paid in cash and in stock. Line 3 contains the details about the impact of the stock issuance on APIC and common stock for the dividends on line 7 and offsets line 7. Line 7 reports the impact on retained earnings. Because the retained earnings will be distributed between cash and stock the most appropriate element to use is DividendsCommonStock for line 7. The DQC rules check if the value of the DividendsCommonStockStock combined with the retained earnings member is the same as DividendsCommonStockStock with no member on the Equity components axis to detect inappropriate use of the DividendsCommonStockStock element.

View: as part of public exposure version master || Return to current approved version.