Consolidated Entities

When the details of variable interest entities are reported in the face financial statements they can either be broken down by line item or as a parenthetical disclosure. In either case the amounts applicable to the variable interest entities in aggregate should use the ConsolidatedEntitiesAxis and the member VariableInterestEntityPrimaryBeneficiaryMember.

DQC Rule 83 identifies those cases where the filer has used VariableInterestEntitiesByClassificationOfEntityAxis with either of the following members on the face financial statements:

- VariableInterestEntityPrimaryBeneficiaryAggregatedDisclosureMember

- VariableInterestEntityPrimaryBeneficiaryMember

and recommends replacement of the axis with the ConsolidatedEntitiesAxis

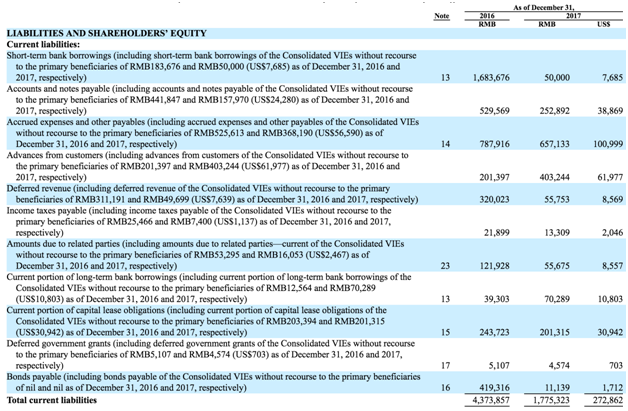

In the example below the company reports the portion of account balances applicable to the variable interest entity as a parenthetical disclosure for each period of the disclosure.

The parenthetical amounts are applicable to the variable interest entity included in the balance sheet line items. As such these disclosures are tagged using the balance sheet line items used in the balance sheet and should use the ConsolidatedEntitiesAxis and the member VariableInterestEntityPrimaryBeneficiaryMember[1]. This member is used because the Primary Beneficiary member represents the value consolidated by the company.

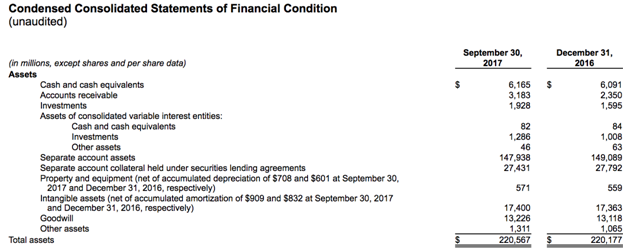

Alternatively the company below has separately reported cash, Investments and other assets specifically for the variable interest entity in the balance sheet with values of 82 and 1,286 and 46 in the column for the year 2017. To ensure tagging consistency with the above example this amount should be tagged with the appropriate balance sheet line item and the ConsolidatedEntitiesAxis and the member VariableInterestEntityPrimaryBeneficiaryMember. The value for $6,165 for cash and cash equivalents on row 1 cannot be tagged with the default value as it excludes the holdings of the variable interest entities.

For values which exclude the amount attributable to the VIE (for example 6,165) the filer should use the member ConsolidatedEntityExcludingVariableInterestEntitiesVIEMember on the ConsolidatedEntitiesAxis with the associated balance sheet line item.

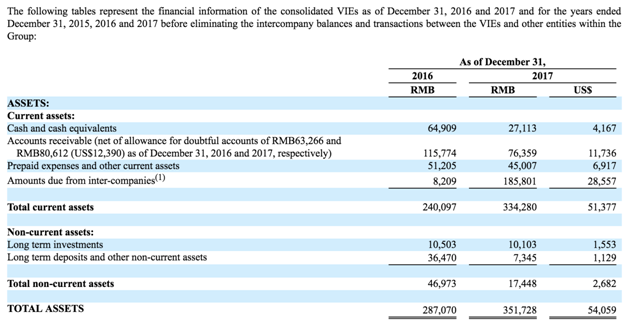

When a company reports the total values for a group of variable interest entities prior to consolidation, the ConsolidatedEntitiesAxis should be reported with the member VariableInterestEntityPrimaryBeneficiaryMember and the ConsolidationItemsAxis with the member ReportableLegalEntitiesMember.

See example below:

All of the values in the table above will be tagged with the members VariableInterestEntityPrimaryBeneficiaryMember and ReportableLegalEntitiesMember.

US GAAP taxonomies up to 2019 included in the VIE section of the taxonomy a balance sheet location axis to facilitate reporting the balances on the balance sheet of the portion applicable to the VIE. This was originally designed to allow the use of the Consolidated VIE line items in conjunction with the BalanceSheetLocationAxis. This approach however is inconsistent with the introduction of the ConsolidatedEntitiesAxis in the US GAAP taxonomy. The recommended approach is to discontinue use of the BalanceSheetLocationAxis and instead use the balance sheet line items with the ConsolidatedEntitiesAxis and VariableInterestEntityPrimaryBeneficiaryMember as discussed above. Filers should not use the following elements for VIE reporting in their filings[2]:

- VariableInterestEntityConsolidatedAssetsCurrent

- VariableInterestEntityConsolidatedAssetsNoncurrent

- VariableInterestEntityConsolidatedCarryingAmountAssets

- VariableInterestEntityConsolidatedLiabilitiesCurrent

- VariableInterestEntityConsolidatedLiabilitiesNoncurrent

- VariableInterestEntityConsolidatedCarryingAmountLiabilities

- VariableInterestEntityConsolidatedCarryingAmountAssetsAndLiabilitiesNet

All of these line items should be expressed using the balance sheet elements (Listed Below) and the ConsolidatedEntitiesAxis with the VIE member VariableInterestEntityPrimaryBeneficiaryMember

- AssetsCurrent

- AssetsNoncurrent

- Assets

- LiabilitiesCurrent

- LiabilitiesNoncurrent

- Liabilities

DQC Rule 82 identifies cases where the incorrect line item elements are used and suggests replacement with the appropriate balance sheet elements.

View: as part of public exposure version master || Return to summary page.