Executive Summary

Reporting, collecting, and analyzing data about individual grants, and the grantees themselves, is time-consuming, labor-intensive, and costly. Grantees prepare multiple forms, and duplicate data reported. Federal awarding agencies and other users of grantee information manually extract data from inconsistently prepared PDF forms or text files. The GREAT (Grants Reporting Efficiency and Transparency) Act aims to improve efficiencies and lower the cost of grants reporting by leveraging data standards. Given the current COVID-related need for relief funds for state and local governments, and nonprofits, greater efficiency is now more critical than ever.

College of DuPage:

- Scott Brady, Chief Financial Officer and Treasurer

- Maki Jursinic, Accounting Supervisor

- David Virgilio, Controller

Reason Foundation:

Marc Joffe, Senior Research Analyst; and Chair, XBRL US Standard Government Reporting Working Group

XBRL US:

- Michelle Savage, VP, Communication

- David Tauriello, VP, Operations

Report preparation applications contributed by IRIS Business Services LLC.

To test the impact of data standards, we conducted a pilot to render information reported about a single grant, plus financial statement data used to evaluate the fiscal health of the grantee, using the open, nonproprietary XBRL (eXtensible Business Reporting Language) standard. The pilot was designed to test whether grants data could be rendered unambiguously machine-readable, and if by doing so, reduce the burden on grantees and federal agencies. Below are key findings:

- Availability of machine-readable grants and grantee data. Financial statement data about the grantee, and about individual grants, e.g., identifiers, funding amounts, and other metrics, were captured in a single set of data standards (taxonomy) with approximately 1,500 data fields. The taxonomy contains descriptive information about each data field and its relation to other data fields. By using the taxonomy, we were able to successfully render the grant application, interim reports, and schedules, as well as the grantee’s financial statements, both human- and machine-readable.

- Reduced burden on grants data users. Machine-readable grantee and grant-specific data reduces the burden on data users because they can extract and analyze data faster, and eliminate manual data entry, and vetting.

- Reduced burden on grantees. Eliminates duplication of data reported. Allows grantees to leverage multiple commercial and open-source applications for data preparation, keeping reporting costs low.

- Easier for federal agency collecting grants data. Changes to reporting requirements can be executed by business analysts, without IT involvement. Taxonomy changes automatically translate to changes in reporting tools used by grantees and data extraction tools used by users of the grants data.

This case study examines the preparation of structured, machine-readable grants data for a single grant awarded to the College of DuPage (COD). The XBRL data standard was used to demonstrate how data standards can be used to support the requirements of the GREAT Act, and to enable automation to reduce costs, improve efficiencies, and enable better outcomes for grantees, federal agencies, and others using grantee data.

Background

Every non-federal entity that spends $750,000 or more in federal grants funding is required to submit to the Federal Audit Clearinghouse (FAC), a Single Audit report, which is an organization-wide financial statement and federal award audit. Grantees must also submit a Form SF-SAC[1] to the FAC, which contains data extracted from the Single Audit report.

In December 2019, the GREAT Act was signed into law. This legislation requires federal government grantees to submit grants data using data standards that:

“...shall, to the extent practicable:

- Render information reported by recipients of Federal awards fully searchable and machine-readable;

- Be nonproprietary;

- Incorporate standards development and maintained by voluntary consensus standards bodies;

- Be consistent with and implement applicable accounting and reporting principles; and

- Incorporate the data standards established under the Federal Funding Accountability and Transparency Act of 2006.”

The GREAT Act also requires grantees subject to Single Audit requirements to report such information in machine-readable form.

The College of DuPage (COD) is a public community college in Glen Ellyn, Illinois, serving nearly 21,000 students, and is one of the largest providers of undergraduate education in the State of Illinois, second only to University of Illinois at Urbana-Champaign.

For the year ending June 30, 2020, COD reported that they had been awarded over $51.64 million in federal grants, and therefore are subject to Single Audit requirements.

The pilot tracked a single grant that had been awarded to COD through the reporting in multiple documents that were submitted to the federal awarding agency and the FAC. This case study describes the current grants reporting process, followed by the approach taken for each step using data standards.

Initial grant application

COD’s grants writer in the Grants Office prepares the initial request for grant funds which can vary in length depending on the complexity of the request. A budget is prepared by the Finance Office. These materials are submitted to the federal awarding agency. The grant used in the pilot was for the FY20 GenCyber Advanced Student Camp, a program designed by the National Security Agency, under the Department of Defense (awarding agency), to expand the number of students studying cybersecurity in the United States.

When COD was invited to apply for the grant, they prepared the SF-424, an online, “PDF-fillable” form provided by the Office of Management and Budget (OMB). Grants-related data reported on the SF-424 includes federal awarding agency, project narrative, contact information, timeframe, and award amount. Some federal agencies use this form, some do not, although the information required to be submitted is generally the same. The COD Grants Office is responsible for the submission, and collects budget and other financial related information from the COD Finance office, as needed. In some cases, the awarding agency may request additional information such as resumes of those performing the work, or letters of support from other organizations.

After the SF-424 was received, the awarding agency sent the grantee a Federal Award Identifier that would be permanently associated with the grant. The Federal Award Identifier is used in subsequent grant reports prepared by COD so that the individual grant can be tracked.

Data standards approach

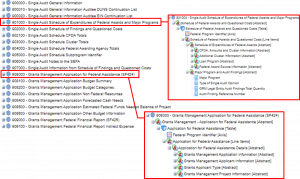

As part of the pilot, the first step was to create a set of data standards to represent the various grants data needed to be reported including the OMB-developed Federal Integrated Business Framework (FIBF) data elements, with additional items created to represent the SF-SAC and financial statements that are included in the Single Audit report. The figure below shows the hierarchy of the data fields in the digital dictionary, called a taxonomy. A group like 901000 - Single Audit Schedule of Expenditures of Federal Awards and Major Programs, shown in the top left call-out box can be disaggregated to show the hierarchy of items that can be used to identify facts on a schedule, as seen in the top right call-out box. Similarly, the items needed to render the SF-424 report machine-readable are found in the group 908000 - Grants Management Application for Federal Assistance (SF24).

Items in the digital dictionary can be used to represent a value reported in the SF-424 or other grants document, or the Single Audit report (including the various schedules and financial statements). The taxonomy is created once, and can be updated whenever reporting needs change. The taxonomy is the “single data model” that can be developed and managed by a single federal agency (like OMB) but leveraged by every other awarding agency.

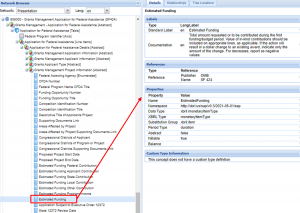

When a value is recorded in the SF-424 or other grants report, it can be associated with a taxonomy concept that has clear, consistent, labels, references, and properties, like Estimated Funding shown in the figure below.

Grants-related data comes in many different data types, such as boolean (e.g., indication if there were any questioned costs related to the audit finding), dates (e.g., reporting period end date), text strings (grantee address), text blocks (e.g., audit finding text) and enumerated items (e.g., type of grant application), in addition to monetary values. The data standard needs to accommodate these data types.

The second step in the pilot was to create an XBRL-formatted SF-424 to represent COD’s grant application. This could be prepared by any one of multiple commercial applications on the market. Given that federal agencies already have a “PDF fillable” form, the primary agency in charge of managing the grants database could revise the online form so that when data is input, a machine-readable SF-424 is generated automatically and submitted to the awarding agency.

The primary agency could also use the digital dictionary (taxonomy) to “auto-generate” an online, fillable SF-424 (or any other required grants report) so that whenever the grantee uses an application to generate an SF-424, the application references the taxonomy and tells the grantee what they need to report. This saves time and effort for the federal agency in charge of maintaining the single taxonomy. The agency can revise the taxonomy to add, change, or delete required items and the taxonomy “communicates” these reporting requirements directly to the applications used by grantees to prepare their documents. Revising the taxonomy does not require IT assistance; it can be managed by agency analysts which improves efficiencies.

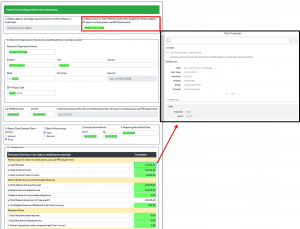

A machine-readable SF-424 can be rendered as XML, JSON, CSV, or even human-readable HTML (called Inline XBRL). A partial view of the COD SF-424, which is both human-readable and machine-readable, is shown below. Click on the image title to go to the actual file. Inline XBRL is HTML with embedded XBRL. Each green-highlighted fact in the report contains an embedded XBRL “tag” that can be read and unambiguously understood by a computer. The black outlined pop-up box to the right is an online viewer that shows metadata about each tagged fact, like the value 36-2594972 which represents the Employer Identification Number (EIN) for the College of DuPage. We can see that by reading it, but now even a computer can understand and extract the value automatically.

College of DuPage SF-424 (Click the image to go to the Inline XBRL file)

Interim Financial Reporting

The Federal Financial Report (SF-425), is often used for periodic reporting to the federal awarding agency, depending on the grant. COD’s Finance Office submitted the SF-425 to the awarding agency for interim reporting on a quarterly basis. As with the SF-424, this was prepared using an online fillable PDF form which transmits it automatically to the recipient, or it can be downloaded and emailed. COD included the Federal Award Identifier, “H98230-19-1-0173” (shown in the top red callout box on the figure below) which was assigned by the awarding agency after submission of the SF-424. The SF-425 also includes data on cash expended, and unobligated amounts, as well as recipient share and income generated by the program, if any.

Data standards approach

We rendered the SF-425 fully machine-readable by leveraging the digital dictionary (taxonomy) and converting the report to Inline XBRL. The image below shows part of the SF-425, with the properties of the value 15,602.22 appearing in the black outlined pop-up box. The properties explain that the fact represents cash receipts in US dollars for the period July 1, 2019 to June 30, 2020.

College of DuPage SF-425 (Click the image to go to the Inline XBRL file)

Annual Single Audit Reporting

COD’s FY2020 Single Audit Report is 155 pages, containing financial statements, text, schedules, and audit information. The COD team prepares the financial statements that go into the Single Audit Report by exporting ledger data from their internal systems into Excel. The college has developed a custom program using Crystal Reports to generate the financial statements in the single audit (which also constitute the college’s Annual Comprehensive Financial Report uploaded to the Municipal Securities Rulemaking Board’s EMMA system).

COD’s auditors prepare the Single Audit Report, including the Schedule of Expenditures of Federal Awards (SEFA) which COD hands off to them. The auditor prepares the audit opinion and schedule of findings, and combines all the needed documents into the draft Single Audit Report PDF. COD reviews and approves the report. Once approved, COD submits a certification notice to the FAC, and the auditor can then submit the Single Audit Report as a PDF. The auditor also prepares and submits the SF-SAC form which is an Excel spreadsheet. Data reported in the SF-SAC is also reported as part of the Single Audit Report.

Data standards approach

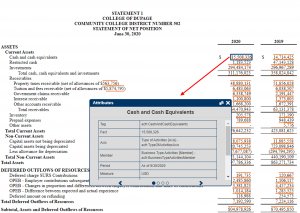

For the pilot, we re-formatted the SF-SAC, a subset of the financial statements, and schedules in machine-readable format so that data contained in any of these documents could be automatically consumed, and immediately used. To do this, we leveraged the same digital dictionary (taxonomy) referenced earlier, then used various commercial and open-source tools to XBRL-format the documents.

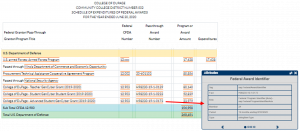

The images below are partial views of the Schedule of Expenditures of Federal Awards, SF-SAC, and financial statements. Every reported value highlighted in red on each report or statement is machine-readable and can be automatically extracted. The Schedule of Expenditures of Federal Awards contains the Federal Award Identifier, H98230-19-1-0173 which is the unique identifier representing the Advanced Student GenCyber Grant (2019-2020), which is also referenced on the SF-425, and if there was an associated audit finding, this identifier would also be found on the SF-SAC.

College of DuPage SEFA (Click the image to go to the Inline XBRL file)

College of DuPage SF-SAC (Click the image to go to the Inline XBRL file)

College of DuPage Financial Statements (Click the image to go to the Inline XBRL file)

Pilot Findings and Conclusions

This case study, tracking a single grant through initial application to ongoing reporting, demonstrates how data standards can be used to monitor the performance of a single grant from start to finish, and can render all grants reporting data in unambiguous, machine-readable format. Benefits to stakeholders from data standards include:

- Federal government agencies:

- The agency tasked with developing and maintaining the data standards need only create the digital dictionary of terms (taxonomy) once, and can update the taxonomy easily (with no IT involvement) to add, delete, or revise reporting requirements.

- Awarding agencies will have immediate access to grantee data at a highly granular level because the data is machine-readable as soon as it’s submitted. Agencies can query and extract data from reports automatically into their internal systems, or simply access the human-readable report as some do today. An Inline XBRL document is human-readable, just like a PDF, but the embedded tags provide additional information beyond what a PDF provides, because the properties of each value can be seen in an online viewer. Awarding agencies that require additional reporting from their grantees (beyond the SF-424 or SF-425) can create taxonomy extension items that can be leveraged by their own grantees so that other data not contained in the standard grants’ reports can be rendered machine-readable as well.

- Grantees and auditors:

- Eliminates duplicate reporting. They will no longer need to prepare the SF-SAC because all the reported data is already included in the Single Audit Report.

- Can prepare grants reports using government agency-provided online forms (just like they do today) that render their data machine-readable; or can use other open source or commercial tools to prepare their reports. Eventually, the reporting in XBRL format can be done directly from their internal financial systems (as many public companies, that prepare their financial statements in XBRL format to submit to the Securities and Exchange Commission each quarter, do today).

- Other users of grantee data contained in the Single Audit Report:

- Will have fully machine-readable data to query and extract, reducing costs, improving timeliness of data, and enabling better quality data.

For more information, contact:

Michelle.savage@xbrl.us, (917) 747 – 1714