Corporate earnings are of keen interest to investors as a critical measure of value. But "unremitted (untaxed) foreign earnings", which have significant implications for corporate earnings, may be off the radar screen of many investors simply because of its placement in company filings, embedded in the notes to the financials. The cumulative balance of untaxed foreign earnings has been growing since 2005 when the Accounting Observer, a research newsletter that analyzes the impact of accounting issues on investments, first began analyzing this data. The volume is more heavily concentrated among larger companies.

Why is this important to shareholders? First, because to remain "untaxed", these amounts must be indefinitely reinvested outside the US and therefore are not available for redistribution to shareholders. Second, U.S. Treasury is taking a harder look at these funds and considering regulation to curb the tax benefits of foreign earnings. Accounting Observer estimated that eliminating these tax benefits would have depressed 2015 earnings for companies in the S&P 500 that have untaxed foreign earnings by between 2.7% and 8.3%. These factors make it important for investors to have easy access to the information reported in company filings on untaxed foreign earnings.

Accounting Observer has been following this issue since 2005 by reviewing data for the companies in the S&P 500. With XBRL, their ability to perform this analysis has been dramatically improved. Here's how.

Before

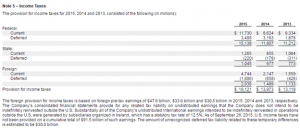

To conduct this analysis required extracting seven data points from 500 separate paper-based filings by pulling the filing online, visually scanning each document and keying the data into a spreadsheet. The screenshot below from the 2015 10-K for Apple, Inc. shows the single value pulled from Note 5 – Income Taxes, on page 55, out of a 76-page report. Two research analysts spent about one week pulling the data – about 80 hours.

Source: Apple Inc., 10-K, period ending 10/28/2015.

After

Today with XBRL, the same analysis can be performed by a single individual in one day, using an online tool to pull seven concepts defined in the US GAAP Taxonomy:

- UnremittedForeignEarnings

- UnremittedForeignEarningsPotentialTaxLiability

- ForeignEarningsRepatriated

- EffectiveIncomeTaxRateReconciliationForeignIncomeTaxRateDifferential

- IncomeTaxReconciliationForeignIncomeTaxRateDifferential

- EffectiveIncomeTaxRateReconciliationRepatriationOfForeignEarnings

- IncomeTaxReconciliationRepatriationofForeignEarnings

Conclusion

One individual can extract, review and validate, and make adjustments to the data in one day – a savings of 72 person-hours in time and resources that can be better spent on valuable analysis. The availability of data standards means that regulators, investors and organizations like the media that serve investors, can conduct analysis more efficiently and at reduced cost.