- Do the Risk Factors section of the 10-Q or 10-K need to be tagged if the company refers to the prior filing that indicates there are no further updates or changes?

- Do the Risk Factors section of the N2 need to be tagged if the company refers to the prior filing that indicates there are no further updates or changes?

- The elements for securities outstanding and asset coverage per unit defined in the 2022 CEF taxonomy are ‘duration’ period type, will this be corrected?

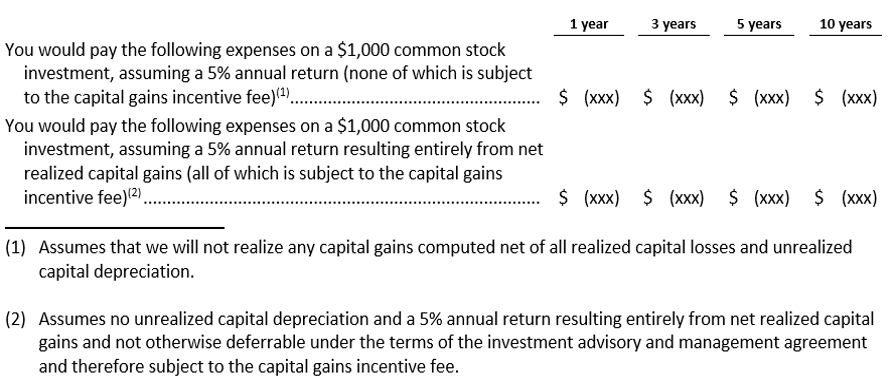

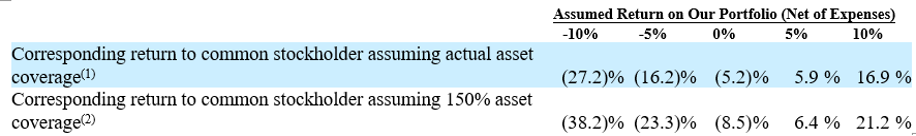

- For the prospectus items such as fee example and effect of leverage, filers sometimes present information based on different assumptions (scenarios). The CEF taxonomy only contains elements to tag one set of the data, how do filers tag other sets of data, if presented?

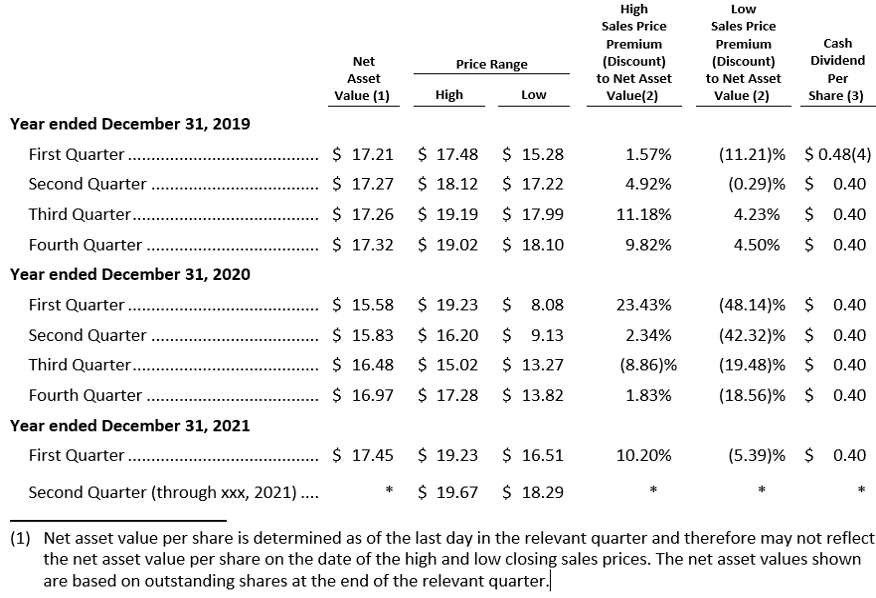

- For the Share Price table, the CEF taxonomy provides elements for Lowest and Highest price or bid of NAV (Net asset value per share), how do filers tag the NAV, if they present the NAV as of the last day in the relevant quarter (instead of Lowest and Highest price).

- Do filers tag the preliminary 424B filing or just the final filing?

A: It is assumed if the risk factors are not tagged this infers that the risk factors have not changed from the prior filing. Data users should assume that an absence of risk factors implies the risk factors are the same as the previous filing. The filer can also choose to tag the risk factors text block if there are no changes.

A: Yes.

A: The elements for securities outstanding and asset coverage per unit defined in the 2022 CEF taxonomy are ‘duration’ period type. This is inconsistent with the ‘duration’ and ‘instant’ period type concepts that are applied in the US GAAP taxonomy. In future releases of the taxonomy these will be defined as instant period type elements. In the interim, the period used in the CEF filings for these elements should follow the durations defined in the CEF taxonomy guide.

A:The CEF taxonomy currently does not have structures to tag multiple sets of such data based on different assumptions (scenarios), filers should tag only one set of data that is resulted from the basic assumption. Any additional sets of data are not required to be tagged, until additional structures and elements are added in the future CEF taxonomy.

A: The CEF taxonomy currently does not have an element to tag the NAV determined as of the last day in the relevant quarter (instead of Lowest and Highest price) for the Share Price table, therefore filers will not be able to tag this information. Filers can start tagging this information when and if additional elements are added in the future CEF taxonomy.

A: Just the final filing.

Questions BDC (10K & 10-Q)

- Do filers need to include Level 1 and Level 3 tags for the Schedule of Investments included in the financial statements and footnotes?

- The equity section on the Balance Sheet of a BDC is often labeled as “Net Assets”. Should filers use the element “AssetsNet” (label: Net Assets”) to tag the total equity?

- When BDC filers are not subject to income taxes (present no income taxes), should the ‘before tax’ or ‘after tax’ elements for investment income, realized gains/losses, and unrealized gains/losses be used on the Statement of Operations and Statement of Changes in Net Assets?

- When filers have no noncontrolling interest, the element Stockholders’ Equity (label: Stockholders’ Equity Attributable to Parent) is used to tag the total equity (net assets) on the Balance Sheet, should the same element be used to tag the beginning/ending balance on the Statement of Changes in Net Assets?

A: Question F.7 in the Staff Interpretations and FAQs Related to Interactive Data Disclosure published by the SEC states “It is the staff’s view that the Schedule of Investments generally should be tagged as a Statement and not a Disclosure Item.” Therefore, the Schedule of Investments should contain Level 4 detailed tagging, but the Level 1 and Level 3 tagging is not required.

A: No. The element “AssetsNet” is a debit balance type element. It is only intended to be used to tag the subtotal for total assets net of total liabilities, if presented. Filers should use the equity (credit balance type) elements to tag the equity section on the Balance Sheet of a BDC, even though it is labeled as “Net Assets”.

A: Filers should use the “before tax” elements to tag the investment income, realized gains/losses, and unrealized gains/losses be used on the Statement of Operations; and use the “after tax” elements to tag the income/loss in the Statement of Changes in Net Assets. When a filer reports the same value for “before tax” and “after tax” investment income, realized gains/losses, and unrealized gains/losses, data users can conclude that there are no income tax expenses.

A: No. Filers should use the broader element “StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest” (label: Stockholders’ Equity, Including Portion Attributable to Noncontrolling Interest) as the beginning/ending balance on the Statement of Changes in Net Assets, even if the values are the same as the stockholder’s equity on the Balance Sheet. When a filer reports the same value for Stockholders’ Equity and StockholdersEquityIncludingPortionAttributableToNoncontrollingInterest, data users can conclude that there is no noncontrolling interest.

Comment

You must be logged in to post a comment.