Implementation dates for FERC Filers

The table below summarizes the due dates for eForms reports, based on the industry forms posted on FERC's Filing Forms page.

| Annual Forms | Quarterly Forms |

|---|---|

| FERC Form Nos. 1 and 1-F will be due on April 18 of the following year. | FERC Form No. 3-Q must be filed within 60 days after the reporting quarter. |

| FERC Form Nos. 2 and 2-A will be due on April 18 of the following year. | FERC Form No. 3-Q must be filed within 60 days after the reporting quarter |

| FERC Form No. 6 will be due on April 18 of the following year. | FERC Form No. 6-Q for each calendar quarter must be filed within 70 days after the end of the reporting quarter. |

| FERC Form No. 60 will be due on May 1 of the following year. | |

| FERC Form No. 714 will be due on June 1 of the following year. |

XBRL Fundamentals

XBRL is an open, nonproprietary, global data standard that renders financial data in machine-readable format. Click on the XBRL features below that FERC filers should understand:Taxonomy

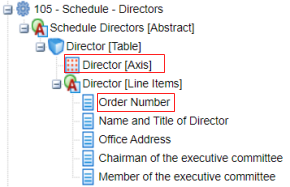

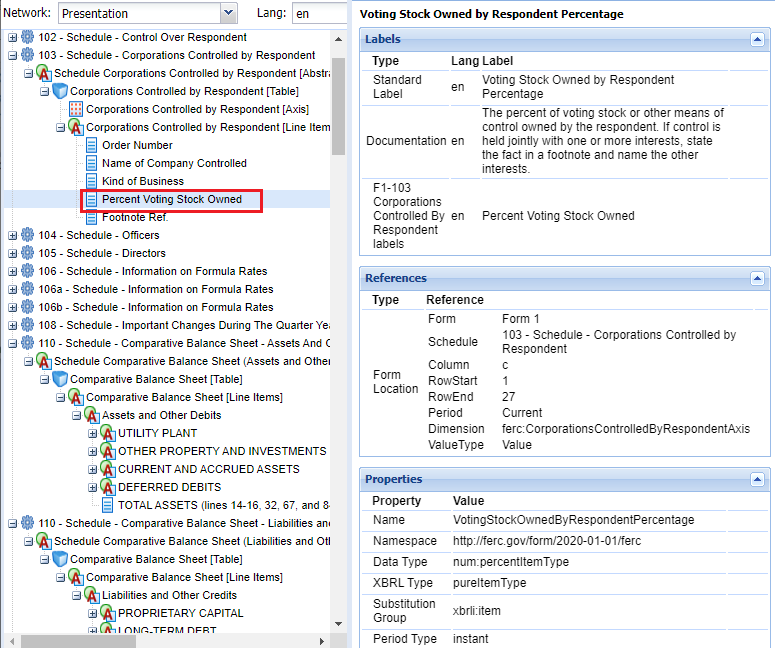

A digital dictionary of XBRL concepts used to report data, describing both those concepts' semantic meanings (for example, the data type, definition, label, references) and their relationships with each other. Figure 1 shows part of the FERC Taxonomy for facts reported on Form 1 for electric utilities. The hierarchical structure of the taxonomy shows that Liabilities and Other Credits is comprised of PROPRIETARY CAPITAL, LONG-TERM DEBT, OTHER NONCURRENT LIABILITIES, ETC. The "+" next to each concept indicates that additional concepts fall under that header.

Instance document (XBRL Report)

A report or document that has been prepared with XBRL tags, for example BP Pipeline’s XBRL-formatted Form 6, or Alaska Electric Light and Power Company’s XBRL-formatted Form 1.

Typed dimensions

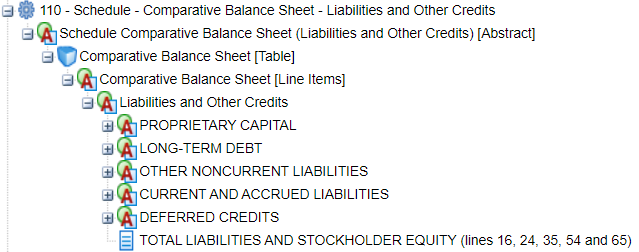

A dimension is an XBRL feature that provides additional information to further define a fact. For example, a fact that you may need to report in a FERC Form 714 like "546" shown on Figure 2, represents the available plant capacity at annual peak demand for the generating plant, Navajo Dynamic. To accurately understand the meaning of "546" requires knowing that it represents:

Similarly, to XBRL tag the value "CALPINE" as shown on Figure 2, would require using the taxonomy concept Electric Utility Name along with the same typed dimension Generating Plants Included in Reporting Balancing Authority Area [Axis], but with the member value set to "South Point Gen Stn. (IPP)".

Typed dimensions are used throughout the FERC Taxonomy to help issuers provide their own company-specific names for facts that represent names of company directors, officers, generating plants, names of companies controlled by respondents, etc.

Similarly, to XBRL tag the value "CALPINE" as shown on Figure 2, would require using the taxonomy concept Electric Utility Name along with the same typed dimension Generating Plants Included in Reporting Balancing Authority Area [Axis], but with the member value set to "South Point Gen Stn. (IPP)".

Typed dimensions are used throughout the FERC Taxonomy to help issuers provide their own company-specific names for facts that represent names of company directors, officers, generating plants, names of companies controlled by respondents, etc.

- Plant Available Capacity at the Hour of the Annual Peak Demand on Net Energy for Load (MW), and

- that it is associated with the plant Navajo Dynamic, which is a member of the group Generating Plants Included in Reporting Balancing Authority Area (in XBRL, this grouping of members is called an Axis).

Similarly, to XBRL tag the value "CALPINE" as shown on Figure 2, would require using the taxonomy concept Electric Utility Name along with the same typed dimension Generating Plants Included in Reporting Balancing Authority Area [Axis], but with the member value set to "South Point Gen Stn. (IPP)".

Typed dimensions are used throughout the FERC Taxonomy to help issuers provide their own company-specific names for facts that represent names of company directors, officers, generating plants, names of companies controlled by respondents, etc.

Similarly, to XBRL tag the value "CALPINE" as shown on Figure 2, would require using the taxonomy concept Electric Utility Name along with the same typed dimension Generating Plants Included in Reporting Balancing Authority Area [Axis], but with the member value set to "South Point Gen Stn. (IPP)".

Typed dimensions are used throughout the FERC Taxonomy to help issuers provide their own company-specific names for facts that represent names of company directors, officers, generating plants, names of companies controlled by respondents, etc.

Explicit dimensions

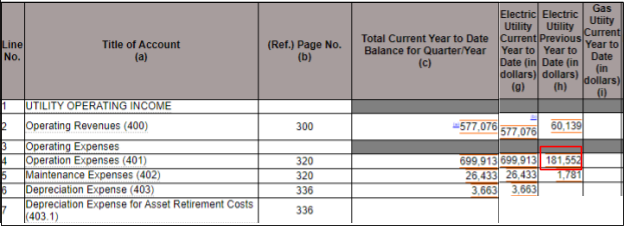

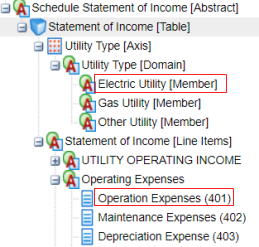

An explicit dimension is similar to a typed dimension in that it is an XBRL feature that provides additional information to further define a fact. Explicit dimensions, however, have predefined members that must be used by the issuer. For example, the Statement of Income on Form 1 can contain data about electric utilities, gas utilities or other utilities. In Figure 4 the highlighted value 181,552 represents operating expense for electric utilities.

The issuer needs to use the XBRL concept Operation Expenses (401) with the Electric Utility [Member] on the Utility Type [Axis] as shown in the taxonomy section on Figure 5. The "members" of this axis are pre-defined as "Electric Utility", "Gas Utility" and "Other Utility" so the issuer must choose from among these preset members.

Text block

A text block is exactly what it sounds like - a block of text which can contain tables and text like the one shown in Figure 6. XBRL allows for the "tagging" of entire sections of text and tables like this, with formatting retained. This example would be identified in XBRL by using the concept Changes During the Quarter or Year which is on Schedule 108 from Form 6.

Validation rules

The FERC has created validation (business) rules which help issuers identify errors that can be corrected before the form is submitted. For example, when run, certain rules check that totals add and cross-add; other rules check periods, units and required elements. Validation rules that issuers run apply to the entire form. For example, rules for annual Form 6 are the same as rules for quarterly Form 6-Q. Every issuer should run the validation rules and can do so by running the rules:

- On the FERC Web site

- On the XBRL US Web site through our checking tool or download software to run the validation rules locally.

Rendering

After issuers have submitted their XBRL filing to the FERC, the FERC will render the XBRL into Inline XBRL format and post it for data users for presentation purposes. They will also make raw XBRL filings available for data extraction. Inline XBRL is a combined HTML (human-readable) and XBRL (machine-readable) file. See examples of rendered Inline XBRL filings for Form 1 and Form 2. Any FERC filer can also render selected schedules* in their FERC filing prior to submission to the FERC through the XBRL US Renderer. XBRL US FERC Filer members can render any schedule or their entire Form.

* For Forms 1, 1F, 1-Q, 3-Q electric, 2, 2-Q, 2-A, 3-Q gas, 6, and 6-Q: Schedules 110, 114, 118, and 120. For Form 60: Schedules 001, 015, and 016. For Form 714: 02.1, 02.3, and 02.6b.

Sorting of data

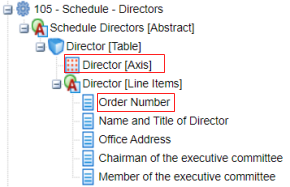

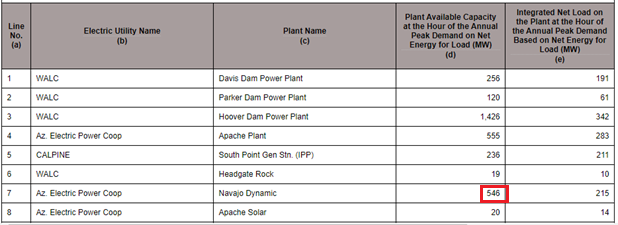

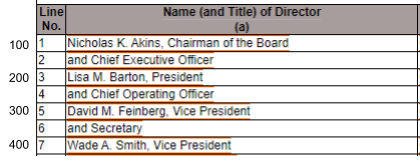

Many FERC Form tables contain lists of content such as the Form 1 Directors Table in Figure 7. Issuers are required to add numbering to tables which specifies the order of the list. The order number must be a decimal so that issuers can insert new rows in the list by adding a new order number. For example on the table in Figure 7 below, the number 100.1 can be added to insert a new row in the list between "Nicholas K. Akins, Chairman of the Board and Chief Executive Officer" and "Lisa M. Barton, President and Chief Operating Officer" which have order numbers of 100 and 200. When this data was migrated, the historic ordering for these lists was retained.

All such FERC lists must be used with a dimension. The Director [Table] is used with the Director [Axis] shown in Figure 8. Order Number is the concept used to report the ordering of the director names, for example "100", "200", etc., as in Figure 7.

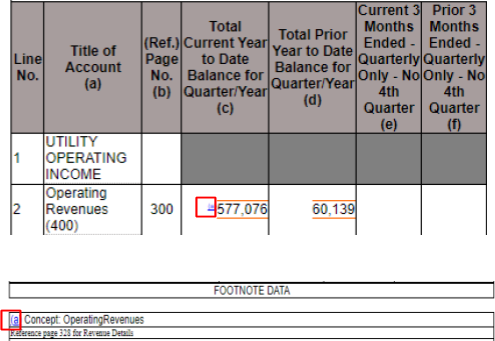

Linking Facts and Footnotes

Software that FERC filers use should support the creation of footnotes and the ability to link a fact to a footnote that appears below the schedule, and to link a fact to a fact. Figure 9 shows a linked footnote.

Accuracy, Units, and Periods

Monetary amounts on FERC forms are reported in US dollars; validation rules will check that the units (set to US dollars) are correct. Monetary numbers must be accurate to the dollar, therefore decimals should be set to zero. Other facts with different data types, for example integers, decimals, kilowatts, or miles, are generally specified by the label on the concept used. Details about the data type are easily found in the FERC Taxonomy Viewer as shown in Figure 10. The concept highlighted, Percent Voting Stock Owned by Others, is described on the right side of the viewing tool. The top right-side panel provides the definition (documentation label) and label (standard label). The middle right-side panel explains where this value is located on the FERC Form location as a reference. The bottom panel provides the concept properties including name, data type (percent) and period type (instant).

Comment

You must be logged in to post a comment.