The Australian government and business saves $1.1 billion every year thanks to a program introduced seven years ago that brought financial data standards into the business to government reporting process. Translated to the American economy, which has a GDP 10 times the size of Australia, the adoption of the right format, information and identifiers – a financial data standard – has the potential to create $11 billion in savings across the US economy. This infographic outlines the problems in U.S. regulatory reporting today.

The savings would be gained by reducing the clutter and waste in the regulatory reporting regime for businesses reporting to government agencies. Today, thousands of public and private companies, as well as financial institutions, report to an estimated 60 separate federal agencies, in addition to the myriad state and local agencies that maintain reporting requirements of their own. For decades, agencies have taken a siloed approach to data governance, interoperability and continually expanding reporting requirements. As a result, companies often report the same information to more than one agency, at different frequencies, using different definitions for the same values.

The single biggest problem caused by lack of standardization is the enormous and unnecessary cost to investors, companies, agencies and American taxpayers, who pay for this bloated system; and the significant burden on companies complying with confusing, duplicative regulatory requirements. This also affects users of the data: the inability to compare reporting organizations, lack of timelines, inaccuracies and big challenges in using data to make decisions.

Adopting the appropriate financial data standard, across all agencies and for all reporting entities would resolve these issues and could translate into the substantial savings that Australia is enjoying today, but at the magnitude of the U.S. economy.

A standard by definition, is a single approach that is used by many, e.g., UPC codes, electrical voltage or WiFi signals. This “sameness” squeezes unnecessary cost out of the process because stakeholders can leverage the same applications.

Here’s what needs to happen.

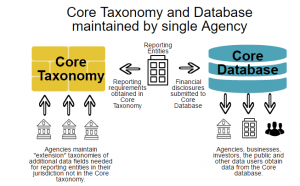

The U. S. Congress must authorize the creation of a single taxonomy and single repository governing all regulatory data reported.

A single government agency must be assigned responsibility to develop, implement, provide oversight and maintenance of a core financial reporting taxonomy that contains data fields used by all agencies. This proposed taxonomy already has a substantial starting point with the XBRL US GAAP Financial Reporting Taxonomy which contains many, if not most, of the reported concepts that are required to be used by corporations and financial institutions today. Individual agencies may require additional data fields that other agencies don’t need – these additional data fields can be maintained in “extension taxonomies” by that agency and can be referenced in the core taxonomy.

Financial institutions and corporations should be allowed to report all regulatory data to a single database that is accessible by all agencies, so that reporting entities don’t need to report the same information to multiple agencies. Agencies can extract information from the repository on an “as-need” basis for monitoring and policy-making purposes. The public can have computer-readable access to any public information as soon as it is available in the repository. This mirrors the existing process with SEC reporting, where public companies submit XBRL-formatted data to the SEC’s EDGAR system and the data is available to regulators, the markets and the public on a real-time basis, in computer-readable form.

Agencies should adopt the same standard identifiers.

For reported facts

Agencies need to accept data from corporations and financial services institutions using the same definitions for the same reporting terms. Agency staff must be responsible for ensuring that datasets are linked and that data reported are of high quality. To enable comprehensive analysis by data users, the definition of Assets must be the same regardless of the reporting organization – a crowdfunded company, an investment company, a corporation listed on the NYSE, a bank, a mutual fund or an OTC company. Using a single core taxonomy for data fields that are reported across multiple reporting entities ensures this level of consistency and eliminates the expense and waste of duplication that happens today.

For legal entities

The Legal Entity Identifier (LEI) – a unique 20-character code that identifies distinct legal entities that engage in financial transactions – should be adopted for all regulatory reporting. This global, non-proprietary standard is freely accessible and designed to uniquely and unambiguously identify participants in financial transactions. It is a standards-based “neutral” code with no embedded intelligence. We expect the LEI, over time, to become the primary identity mechanism for entities around the world.

For industry classification

To facilitate cross-border comparison of securities, U.S. agencies should work with securities agencies around the world to adopt a single standard for business classification.

For securities

Public companies and financial institutions should be required to identify their securities using an open, nonproprietary, freely available standard.

CUSIP numbers, which are more commonly used in the U.S., are both securities identifiers and entity identifiers but CUSIP is not global, and it is a proprietary (not free or open) standard. Another option is the International Securities Identification Number (ISIN) which is defined in ISO 6166 and uniquely identifies a security. An ISIN number however, is linked to a CUSIP number so while it is global, it is not open nor is it free.

A third option is the Financial Institutions Global Identifier (FIGI); although FIGI was developed and is maintained by Bloomberg, it is an open, freely available standard. Using this standard will allow investors to obtain reliable additional data about that security from alternative locations and eliminate the need for companies to repeatedly report reference data in their filings. This will also align the standard with securities identifiers used in financial services reporting like money market funds.

For foreign issuers, both the principal U.S. market and the principal established foreign public trading market(s) should be disclosed. Because many of these securities are traded as American Depository Receipts (ADR), it is not always easy to identify the underlying security which represents the ADR. In addition, if a security is traded in a U.S. market as an ADR, the ADR ratio should be required to be reported by the company. Currently, this data is not always easily available to investors.

For swaps data

US Treasury’s Office of Financial Research (OFR) has developed a data collection mechanism for swaps data which should be required for all swaps reporting.

This approach will be highly beneficial to U.S. industry and government, and could just get us to the kind of savings we’ve seen in Australia, but at the scale of the U.S. economy. This infographic shows how this will work.

Who will benefit?

Data standards will reduce costs, improve accuracy and timeliness and streamline processing for regulatory agencies, public companies and financial institutions reporting in to the agencies and the public.

Agencies

One of the most significant benefits of data standards for agencies is in stripping the costs out of a bloated, inefficient regulatory system. The Australian SBR program requires businesses to report to government agencies using a single agreed-upon standard. This initiative was implemented in Australia and in the Netherlands. The program was initially projected to save $800 million annually; in reality, the program has exceeded expectations. Six years after implementation, savings across government and business of $1.1 billion have been realized. There are important benefits of standards beyond cost savings, including enhanced timeliness and greater clarity of information delivered which in turn, provide governments access to better, more timely information for decision-making.

Reporting entities

The reporting burden on public companies and financial institutions can be greatly reduced by reporting data once to a single agency rather than to multiple agencies (eliminating the duplication that takes place today). Reporting entities also gain from access to more timely, comprehensive data from peers for their own analysis.

Public and other data consumers

Data consumers gain from inexpensive and easy access to more timely and accurate data filed with agencies. From a single, standardized financial reporting repository, users can query a single source, instead of manually searching for information contained in various filings and formats, submitted by companies to separate agencies. A standardized repository creates the possibility of automated extraction and real-time analysis for all.

The public benefits from fiscal transparency driving better policy decisions by government, which can evaluate economic trends and corporate and financial activities faster, using more consistent data.

Why wait? The time is now to take a stand for reducing unnecessary spending in government, by streamlining an existing, siloed approach that has evolved over time.

Read the white paper for more detail on this approach.