June, 2020

XBRL US CEO blogs about “Single audit, data standards and the GREAT Act”. President and CEO Campbell Pryde explains the importance of understanding all the facts behind how Single Audit reports are prepared today, and how data standards required in the GREAT Act are designed to improve the process for grantees, auditors, government data collectors and data users.

As noted in the post, “The success of the GREAT Act depends on the data standards, and the implementation.That’s why it’s important to have all the facts on how grantees report today, and on how the right standard can be applied to not only meet the ‘letter of the law’, but more importantly, fulfill the promise of the GREAT Act.” To help explain further, watch the video. Read the infographic.

SEC updated custom tag analysis, shows slight decline in custom tag rates. The updated analysis of custom tag rate trends shows a slight decline in the use of custom tags (from 18% to 17%) for all filers. The biggest decline in the use of custom tags was from large accelerated filers which was offset by an increase among smaller reporting companies.

SEC publishes request for comment on Form N-CEN. The request concerns the collection of data by investment companies on Form N-CEN, which is currently required to be reported in XML format. It seeks information on: (a) whether the proposed collection of information is necessary for the proper performance of the functions of the agency, including whether the information will have practical utility; (b) the accuracy of the agency’s estimate of the burden of the collection of information; (c) ways to enhance the quality, utility, and clarity of the information collected; and (d) ways to minimize the burden of the collection of information on respondents, including through the use of automated collection techniques or other forms of information technology. Comments are due by mid-August.

FASB publishes Q&A on using the US GAAP Taxonomy for COVID-19 disclosures. The new Q&A addresses how to apply the US GAAP Financial Reporting Taxonomy on disclosures related to effects of COVID-19. Topic areas covered include income taxes, payroll taxes, loans, grants, pensions, and overall discussion of the COVID-19 pandemic.

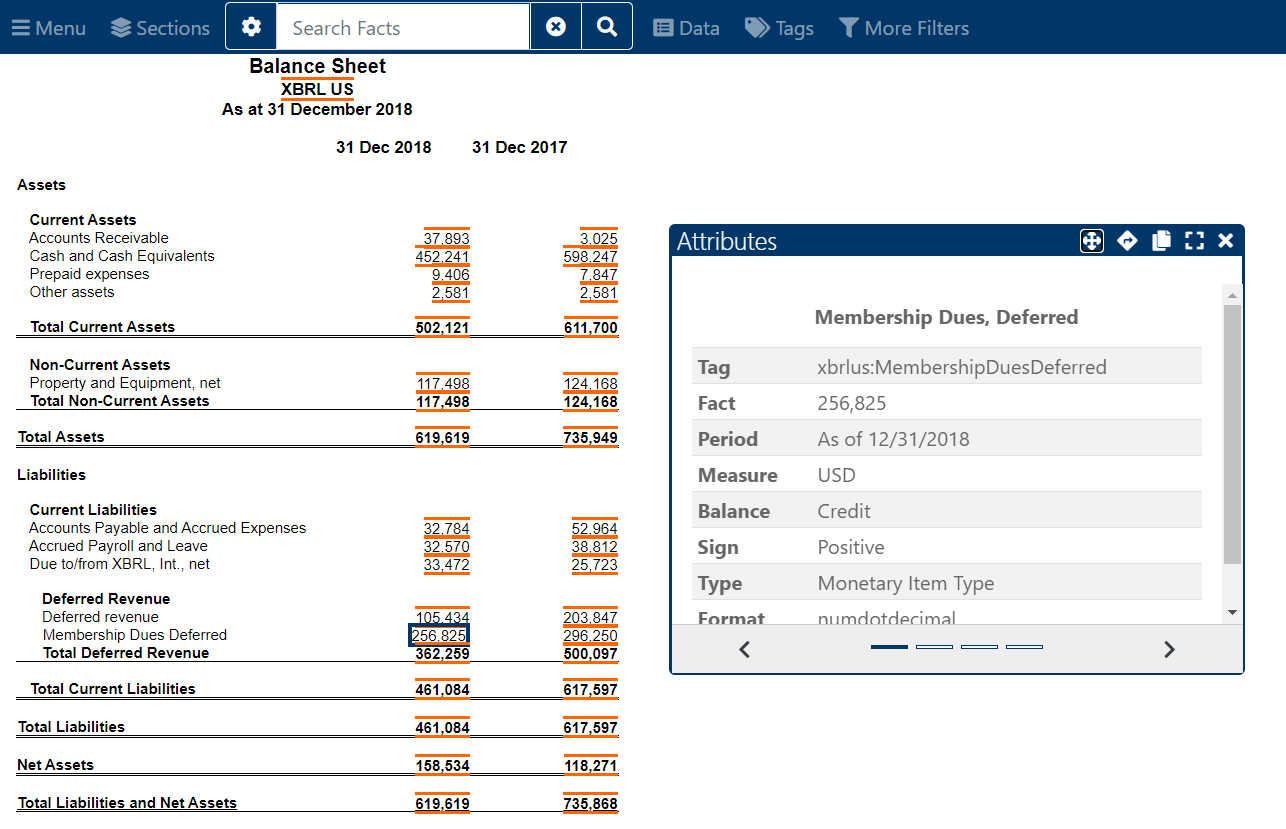

XBRL US publishes Inline XBRL formatted financials. Financials for 2018 and 2017 have been posted. 2019 financials will be posted later this Summer after an audit has been completed.

Two new XBRL US member working groups launched, focusing on SEC reporting. The Domain Steering Committee (DSC) jumpstarted the Earnings Subcommittee, a working group focused on investigating the possibility of XBRL formatting of Form 8-K earnings announcements. This group was originally started about a year ago and has been on hiatus. The next monthly call will be held July 16, at 2PM ET.

Separately, the newly formed XBRL EDGAR Working Group was established as a subcommittee of both the DSC and the Communications Steering Committee (CSC). The purpose of the group is to establish an ongoing dialogue with the SEC to facilitate smooth implementation of new SEC requirements related to XBRL and other structured data filing requirements; to encourage the SEC to allow for test periods when implementing new XBRL or other structured data requirements, as well as certain EDGAR Filer Manual changes; and to establish a channel for communication from vendors and the filing community on the impact of new rules that have XBRL or other structured data components. The next call is scheduled for Tuesday, July 14 at 3 PM ET.

All XBRL US members are invited to join one or both of these new groups. Contact info@xbrl.us to learn more.

XBRL US Activities

Recent XBRL US Webinars

- Understanding the FERC Taxonomy, Session 2 (Members-only Webinar), June 10 – listen to replay: https://xbrl.us/events/200610

Upcoming XBRL US Data Quality Committee Meeting

The next meeting will be held Wednesday, July 15, at Noon EDT. Get information about the Committee and register to attend this web conference meeting: https://xbrl.us/dqc

Upcoming XBRL US Steering Committee and Other Member Meetings

- The Domain Steering Committee will meet Thursday, July 9 at 11 AM EDT.

- The Communications Steering Committee will meet Tuesday, July 21 at 3 PM EDT.

XBRL US Members are encouraged to attend and get involved. Email membership@xbrl.us for details.

XBRL US Members are committed to engaging and collaborating with other members, contributing to the standard through involvement of their teams, and striving to build awareness and educate the market. Members of XBRL US represent the full range of the business reporting supply chain.

XBRL US Members are committed to engaging and collaborating with other members, contributing to the standard through involvement of their teams, and striving to build awareness and educate the market. Members of XBRL US represent the full range of the business reporting supply chain.

Not yet an XBRL US member? Maybe it’s time to consider joining XBRL US for yourself ($55 – $500/ year) or your organization (fees vary). Find out more about the benefits of membership and how to become involved by visiting https://xbrl.us/benefits.

Comment

You must be logged in to post a comment.