March 2023

Online training programs from XBRL US are now freely available for regulators, developers and businesses. Three programs covering XBRL Fundamentals, Understanding the US GAAP Taxonomy, and Introduction to XULE (an open source processing language) have been developed to educate stakeholders in the reporting ecosystem. The first two programs include short videos and quizzes to test your knowledge. Introduction to XULE uses online exercises to help technologists learn how to use an open-source language to work more efficiently with XBRL data. More programs will be developed in the coming months.

The Financial Accounting Standards Board (FASB) issues action alert request for comment for two proposed GAAP Taxonomy Improvements. The first addresses Proposed ASU on Improvements to Income Tax Disclosures. Comments on these proposed improvements must be received by May 30, 2023. The second, Proposed Accounting Standards Update—Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60): Accounting for and Disclosure of Crypto Assets, aims to improve the accounting for and disclosure of certain crypto assets. Comments are due by June 6, 2023.

SEC commissioners unanimously support a rule proposal advocating more electronic reporting. The proposal, Electronic Submission of Certain Materials Under the Securities Exchange Act of 1934; Amendments Regarding the FOCUS Report requires broker dealers and other registrants to electronically file certain forms that are currently allowed to be submitted in paper format. Comments are due 60 days after publication in the Federal Register or May 22, 2023, whichever is later. Requirements specific to data standards are referenced in the proposal as follows:

Specifically, the Commission is proposing to require the report required by Exchange Act Rule 15fk-1(c)(2)(ii)(A) and portions of Form 1, Form CA-1, Form 17-H, and Form X-17A-5 Part III and related annual filings to be provided in the Inline eXtensible Business Reporting Language (“Inline XBRL”) structured data language. The Commission is also proposing to require Form X-17A-19, the notice to the Commission (and any amendments to the notices) required by Exchange Act Rule 15fi-3(c), and portions of Form 1-N, Form 15A, Form 1, Form CA-1, Form 17-H, and Form X-17A-5 Part III and related annual filings to be provided in machine-readable, eXtensible Markup Language (“XML”)-based data languages specific to those documents (“custom XMLs”). As noted, these structured documents would be filed or submitted on EDGAR.

In addition, the Commission is proposing to require SROs to electronically post the information required under Rule 19b-4(e) using a custom XML-based data language (also referred to as a “schema”) that the Commission would create and publish on its website for SROs to use. The Commission is also proposing to require SROs to post a rendered Portable Digital Format (“PDF”) version of the custom XML document using a PDF renderer that the Commission would also create and publish on its website for SROs to use.

Separately, the SEC publishes the proposal, Addressing Cybersecurity Risks to the U.S. Securities Markets. This proposal (read the fact sheet) calls for broker-dealers, the Municipal Securities Rulemaking Board, clearing agencies, major security-based swap participants, national securities associations and exchanges, security-based swap data repositories and swap dealers, and transfer agents, to address their cybersecurity risks. They will be required to adopt policies and procedures, and in the event of a significant cybersecurity incident, report to the SEC on proposed Form SCIR. In addition, these entities would need to publicly disclose summary descriptions of their cybersecurity risks and incidents. The rule calls for Form SCIR to be prepared using a custom XML schema. Comments are due within 60 days from publication in the Federal Register.

SEC EDGAR System is upgraded and now supports 2023 taxonomies. The SEC announced that the EDGAR System has been upgraded to Release 23.1, and now supports 2023 taxonomies. The newly released Executive Compensation Disclosure (ECD) taxonomy now includes the elements needed for tagging disclosures required by the Commission’s final rule on Insider Trading Arrangements and Related Disclosures. The 2023 U.S. Generally Accepted Accounting Principles (GAAP) Financial Reporting Taxonomy and the 2023 SEC Reporting Taxonomy reflect the same taxonomy versions that the Financial Accounting Standards Board made available on its website on December 16, 2022. All supported standard taxonomies can be found here.

FASB announced that the SEC has accepted the 2023 GAAP Financial Reporting Taxonomy (UGT) and the 2023 SEC Reporting Taxonomy (SRT). The FASB also announced that they had finalized the 2023 DQC Rules Taxonomy.

A free webinar on Tuesday, April 11 will review improvements to the 2023 UGT and SRT, feature a discussion between PwC’s Wes Bricker and FASB Chair Richard R. Jones, and offer an update from SEC staff of observations on data quality.

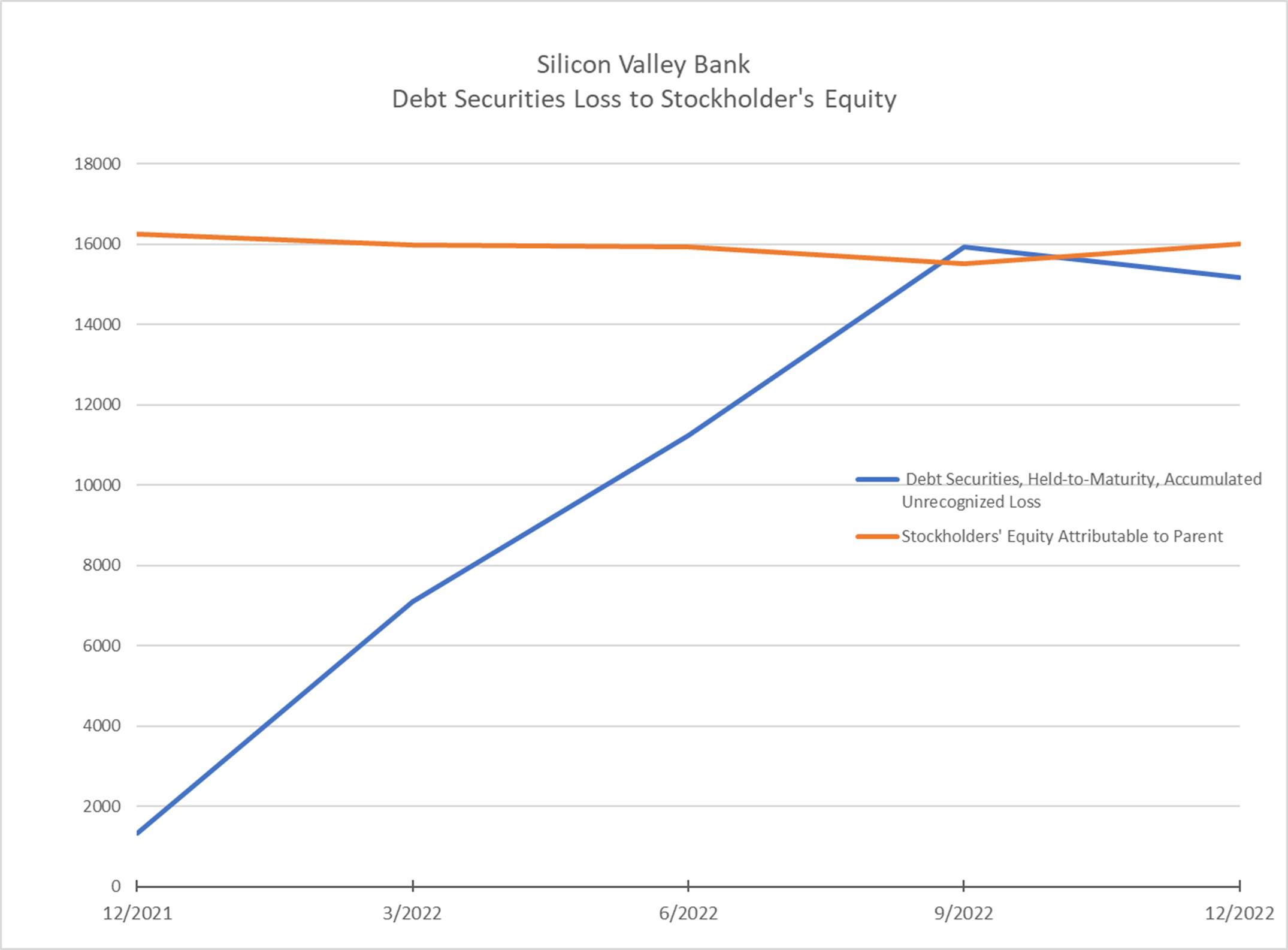

Blog – Silicon Valley Bank losses hiding in plain sight

Campbell Pryde, President and CEO, XBRL US

Silicon Valley Bank went bankrupt because of unrecognized losses on held-to-maturity securities that were greater than the bank’s equity. These losses started climbing as early as March of 2022. If the bank was forced to sell these securities and thus realize the loss, they would have negative equity. The losses were not reported on the income statement or balance sheet, but they were easily available in the notes to the financials, and they were conveniently tagged in XBRL format.

XBRL US & Member Events

FASB Webcast: 2023 GAAP/SRT Taxonomy Improvements & SEC Update, Tuesday, April 11, at 1 PM ET

This webcast will discuss improvements to the 2023 GAAP Financial Reporting Taxonomy (Taxonomy) for recently issued FASB Accounting Standards Updates (ASUs) and to the 2023 SEC Reporting Taxonomy (SRT) based on feedback and internal analysis collectively referred to as the “2023 Taxonomy Releases.” Details and registration: https://xbrl.us/events/fasb-230411

Webinar Replay: Government Financial Reporting – Data Standards and the Financial Data Transparency Act

The Financial Data Transparency Act (FDTA) requires data standards to be used by municipal bond issuers for financial statement reporting to the Municipal Securities Rulemaking Board (MSRB). Attend this 60-minute session to explore government data standards, find out how governments can create their own machine-readable financial statements, and find out the impact on government entities. Most importantly, discover how machine-readable data standards can benefit state and local government entities by reducing costs and increasing access to time-sensitive information for policy making. Watch the replay: https://xbrl.us/events/230124/

At its March 21 meeting, the Data Quality Committee (DQC) approved version 21 of its rules to be made available for public comment starting April 15. The next DQC meeting is scheduled for June 14. Get information about the Committee: https://xbrl.us/dqc.

XBRL Data Community – Live Support

Anyone can use this Google Meet link on Mondays between 3:30 and 4:30 PM ET to get help from XBRL US Staff with the XBRL API, our resources, etc.

NEW!! – non-Members who request XBRL API provisioning with an organizational email address get a 10-day trial of full Member access to evaluate this benefit.

Upcoming XBRL US Steering Committee and Other Member Meetings

The Domain Steering Committee will meet Tuesday, April 18, at 2PM ET. https://xbrl.us/events/dsc-230418 – all XBRL US Members are invited to attend

The Communications Steering Committee will meet Tuesday, April 18, at 3 PM ET. https://xbrl.us/events/csc-230418 – all XBRL US Members are invited to attend

The Regulatory Modernization Working Group will meet Wednesday, April 19, at 3 PM ET. (membership@xbrl.us for details)

The Standard Government Reporting Working Group will meet Tuesday, April 25, at 12:30 PM ET. (membership@xbrl.us for details)

XBRL US Members are encouraged to attend and get involved.

XBRL US Members are committed to engaging and collaborating with other members, contributing to the standard through involvement of their teams, and striving to build awareness and educate the market. Members of XBRL US represent the full range of the business reporting supply chain.

Not yet an XBRL US member? Maybe it’s time to consider joining XBRL US for yourself ($55 – $550/ year) or your organization (fees vary, starting at $525 annually). Find out more about the benefits of membership and how to become involved by visiting https://xbrl.us/benefits.

Comment

You must be logged in to post a comment.